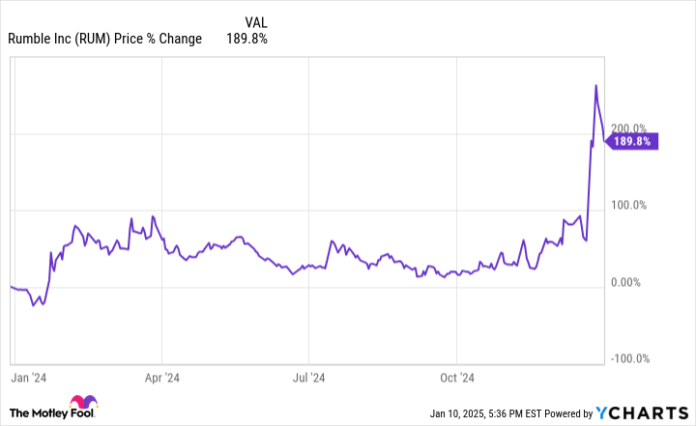

Rumble (RUM -5.92%) inventory recorded explosive positive factors throughout 2024. The video-streaming firm’s share worth rocketed 189.8% greater in final yr’s buying and selling, in response to information from S&P World Market Intelligence.

Rumble inventory posted massive positive factors in 2024 because of new content material offers, political tailwinds, and a push into the cryptocurrency area. However the firm’s share worth began to see a major pullback close to the very finish of the yr, and sell-offs have continued in 2025.

Rumble inventory had an enormous 2024

Rumble inventory noticed some sturdy positive factors early final yr after the corporate introduced that it had entered right into a partnership with Barstool Sports activities. By their deal, Barstool introduced content material to Rumble’s video streaming platform and likewise shaped an promoting relationship with the corporate.

For months afterward, Rumble inventory noticed average strikes up and down. However the inventory did begin seeing upward momentum main as much as and following Donald Trump’s victory within the presidential election. A lot of the content material on Rumble skews towards the appropriate aspect of the political aisle, and a few buyers purchased into the inventory as a option to revenue from a Trump election win.

Then, Rumble printed a press launch on Nov. 25 detailing its new cryptocurrency technique. Per the announcement, the corporate mentioned that it was planning on shopping for as much as $20 million value of Bitcoin. The inventory gained floor following the announcement, however there was different crypto-related information that powered even greater positive factors.

On Dec. 20, Rumble introduced that it had secured $775 million in funding from Tether — the corporate behind the Tether stablecoin. By the deal, Rumble might be promoting $775 million value of recent inventory to Tether at a worth of $7.50 per share. The streaming specialist will use $250 million of the cash from the inventory sale to fund its development initiatives and the opposite $525 million to purchase again inventory from different massive shareholders. Rumble inventory noticed huge positive factors on the information as some buyers guess that the corporate could possibly be within the early levels of seeing bigger crypto-related tailwinds.

Why is Rumble inventory sinking in 2025?

After a powerful run final yr, Rumble inventory has seen an enormous pullback early in 2025’s buying and selling. As of this writing, the corporate’s share worth is down 15.8% yr to this point.

Rumble inventory has been shedding floor attributable to rising macroeconomic threat elements. Current U.S. jobs information printed by the Bureau of Labor Statistics has raised issues that inflationary pressures may wind up being stronger than beforehand anticipated. Because of this, the Federal Reserve may take a extra cautious strategy to chopping rates of interest — which might be an unfavorable improvement for development shares.

With the corporate at present valued at roughly 27.4 occasions this yr’s anticipated gross sales, Rumble has a extremely growth-dependent valuation and will see additional share worth contraction if macroeconomic pressures intensify. Moreover, it is not clear that the cope with Tether will do a lot to alter the corporate’s fundamentals.

Whereas the inflow of money will assist the corporate fund its operations and pursue development avenues, Rumble’s streaming platform has been placing up regarding engagement and monetization numbers. Political tailwinds and cryptocurrency connections may give shares a lift, however buyers ought to strategy this inventory with the understanding that it is a dangerous play.

Keith Noonan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Bitcoin. The Motley Idiot has a disclosure coverage.