Shares of Intel (INTC 0.70%) have been spiraling once more final month because the shock “retirement” of former CEO Pat Gelsinger supplied extra proof of the disarray the corporate is in because it struggles to maintain tempo within the booming chip sector.

Traders have grasped on to hopes of a restoration, however the CEO ouster is the most recent proof of steep challenges at a time when the corporate can ailing afford to fall behind.

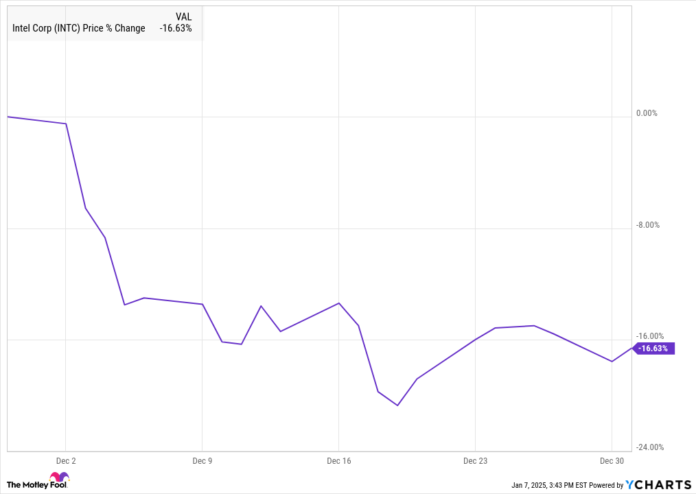

Consequently, the inventory completed the month down 17%, in accordance with information from S&P International Market Intelligence. As you may see from the chart, the inventory plunged shortly after the CEO announcement, and stayed down from there, falling once more after the Federal Reserve trimmed its rate-cut forecast for 2025.

Intel goes from unhealthy to worse

Traders initially reacted favorably to the information that Gelsinger was stepping down, although it did not take lengthy for that shine to put on off, and traders appeared to understand the plan to interchange him was missing.

Intel named two interim co-CEOs in Gelsinger’s place, CFO David Zinsner and Michelle Johnston (MJ) Holthaus, the CEO of Intel Merchandise. The transfer leaves Intel with out a everlasting chief when it is in the midst of an enormous transition, having stated it might lay off 15% of its workforce in August, because it’s within the midst of a years-long pivot to a brand new foundry mannequin that opens up its factories to outdoors clients.

Pushing Gelsinger into retirement with out a substitute leaves the corporate with out leverage in government negotiations, and the place could possibly be a tricky promote, given the struggles of the enterprise, the floundering inventory value, and its transition to the foundry mannequin.

Due to this fact, it isn’t stunning that the corporate hasn’t stuffed that place greater than a month after Gelsinger’s departure.

What’s subsequent for Intel?

Intel did make another strikes final month, together with including two new board members, and rumors swirled that it might absolutely spin off the foundry enterprise. Nonetheless, the detrimental media consideration across the firm’s efforts to discover a new CEO additionally appeared to weigh on the inventory.

Shares have been flat to start out January, as The Wall Road Journal piled onto the criticism, saying that the corporate is shedding market share in a number of areas and has even fallen behind AMD in information middle income.

Traders additionally shrugged off the discharge of the corporate’s newest AI PC chips at CES in Las Vegas this week, whereas Nvidia gained many of the consideration.

There is not any query Intel is in a deep gap at this level. A gifted chief might be able to dig the corporate out, but it surely looks as if the corporate’s issues will worsen earlier than they get higher, in the event that they ever do.

Jeremy Bowman has positions in Superior Micro Gadgets and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Intel, and Nvidia. The Motley Idiot recommends the next choices: quick February 2025 $27 calls on Intel. The Motley Idiot has a disclosure coverage.