BigBear.ai (BBAI 14.25%) inventory is posting huge beneficial properties in Monday’s buying and selling regardless of sell-offs for the broader market. The software program firm’s share worth was up 16.2% as of three:15 p.m. ET, whereas the S&P 500 index and the Nasdaq Composite index had been each down 0.8%.

BigBear.ai inventory is surging right this moment due to bullish protection from H.C. Wainwright. The agency’s lead analyst on the corporate reiterated a purchase ranking and raised his one-year worth goal on the inventory from $3 per share to $7 per share.

BigBear.ai inventory surges on new worth goal

Earlier than the market opened right this moment, H.C. Wainwright printed new protection on BigBear.ai inventory. As of this writing, analyst Scott Buck’s new one-year worth goal of $7 per share implies extra upside of 40%.

Buck is bullish on the corporate’s transfer to refinance convertible senior notes price $182.3 million, pushing the maturity date from 2026 to 2029. With the transfer, BigBear is minimizing near-term liquidity points and giving itself extra flexibility to spend on development bets. The analyst additionally sees BigBear benefiting from a market surroundings that’s changing into extra favorable to development shares with smaller market caps and thinks the corporate’s standing as a man-made intelligence (AI) pure play may help assist a premium valuation.

What comes subsequent for BigBear.ai?

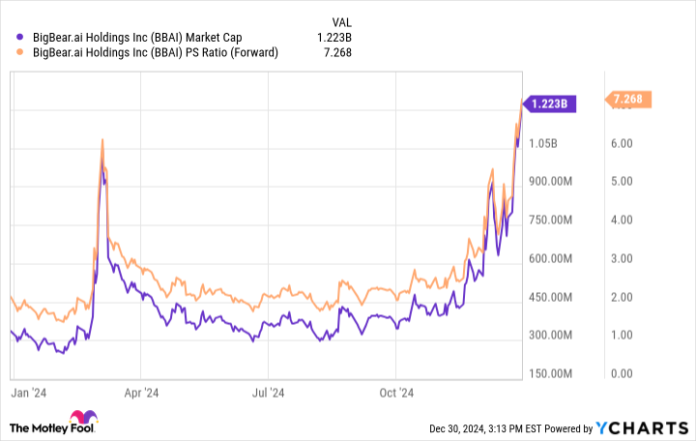

With right this moment’s beneficial properties, BigBear inventory is now up 129% throughout 2024’s buying and selling. The share worth beneficial properties and new inventory choices have pushed its market cap as much as $1.2 billion. The corporate is now valued at roughly 7.3 occasions this 12 months’s anticipated gross sales.

BBAI Market Cap knowledge by YCharts.

With its third-quarter report, BigBear grew its gross sales 22% 12 months over 12 months to succeed in $41.5 million. Then again, the corporate famous that it was seeing some cautiousness from authorities prospects when it got here to AI spending. Whereas the inventory might be able to preserve rallying, the corporate might must ship extra bullish contract steering or accelerating gross sales development with its subsequent quarterly report with the intention to assist latest share worth beneficial properties.

Keith Noonan has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.