In search of a high-yield ETF to spice up your earnings in the long term? It is by no means too early to start out planning your nest egg’s dividend payouts, and this not too long ago launched ETF may very well be simply what you want.

Excessive-yield funds might be dangerous. In an ideal world, each ultra-generous dividend yield can be a direct results of sturdy companies producing a lot of extra money income. In the actual world, they’re extra usually associated to low inventory costs and companies in deep monetary bother. Because of this, excessive yields are usually paired with disappointing value charts and modest whole returns, at finest.

What if I informed you that one of many largest income-focused exchange-traded funds (ETFs) in the marketplace at this time combines wealthy yields with spectacular fund-price features? The JPMorgan Nasdaq Fairness Premium Earnings ETF (JEPQ 0.83%) checks each of these shareholder-friendly containers — and plenty of extra.

Why this younger income-oriented ETF is popping heads

The Premium Earnings ETF is a really younger fund, launched in Could 2022. You might also have skipped it within the large sea of income-generating ETFs as a result of it is an actively managed fund. Passive index funds have a tendency to return with decrease annual charges, so it is smart to start out your fund-screening course of with that criterion.

However this JPMorgan instrument could also be properly value its 0.35% administration price. Here is a fast rundown of the fund’s distinctive qualities:

The great:

- The Premium Earnings ETF’s skilled administration crew depends on information science to pick high-income shares from the growth-oriented Nasdaq 100 market index.

- 54% of the portfolio is at the moment invested in data expertise and communication companies — two market sectors intently associated to the continuing synthetic intelligence (AI) growth.

- The highest 10 holdings embody your entire checklist of “Magnificent 7” shares — confirmed winners with very giant market caps.

- A few of these tech giants do not pay dividends, however the fund managers generate month-to-month earnings from them in different methods.

- Annual dividend yields at the moment stand at 9.3% after rising above 12% over the summer season.

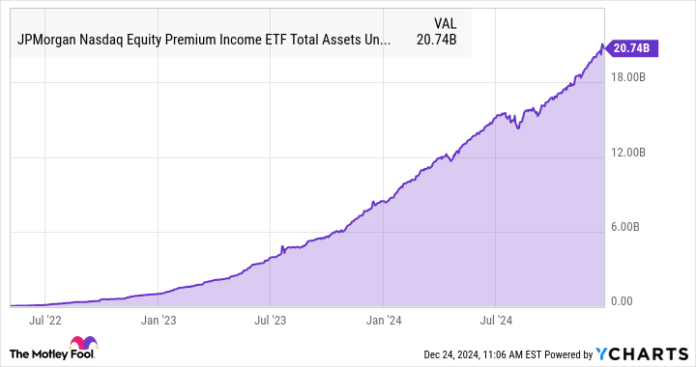

- It has a large $20.7 billion of property beneath administration, regardless of its quick market historical past. Buyers had been fast to embrace this promising new fund:

JEPQ Whole Property Below Administration information by YCharts.

The dangerous:

- The dividend-boosting strategies embody some dangerous methods, akin to promoting short-term name choices to generate funds out of risky shares. That is nice when it really works, however may additionally lead to weak fund efficiency and decrease yields in a persistent market downturn.

- The fund was launched a few months earlier than this bull market began. It has not but been examined in a weak economic system, which may unleash the downsides of option-based investing ways.

- The 0.35% administration price might not appear like a lot, however it’s far above the 0.06% common of the ten largest ETFs at this time and even additional forward of low-cost funds such because the Vanguard S&P 500 ETF (VOO 1.03%). The price may really make an enormous distinction in the long term. The Vanguard fund’s 0.03% annual price provides as much as 0.3% in a decade, whereas the Premium Earnings ETF’s charges would whole 3.6% over the identical interval.

The choices-based earnings technology leads to a month-to-month dividend payout as a substitute of the same old quarterly checks. You’ll be able to name that an upside or a draw back, relying on which payout cadence you favor.

How the ETF stacks up towards the S&P 500

The Premium Earnings ETF’s whole returns have matched broad market trackers just like the Vanguard S&P 500 ETF since its 2022 inception. On the similar time, the fund value has solely elevated 28%, whereas the market tracker rose by 46%. In different phrases, the fund stays moderately priced, even in a uncommon market surge, and you are still locking in some unbelievable dividend payouts for the long term.

Lengthy-term dividend yields

The month-to-month payouts added as much as $5.38 per share over the past 12 months, or a ten.7% yield towards the present share value of roughly $58. I am unable to promise that the fund will increase its payouts without end, given its reliance on unconventional options-based strategies, however it may very well be helpful to think about how a modest payout enhance may play out over time.

We could say that the fund’s annual whole returns hover across the 10% mark over the subsequent decade — a reasonably cheap assumption for a fund that tends to match the S&P 500. I might assume that the dividend payouts enhance at an analogous charge, which ends up in a 159% enhance over the subsequent decade.

You’d nonetheless have a present yield of 9.3% at that time, however the identical payout represents a 24% yield towards the unique buy value. In case you’re on the lookout for sturdy dividend payouts 20 years down the street, this fund may provide you with an efficient yield of 62% on an funding made in 2024.

This thought experiment depends on many assumptions, however you get the concept. Even when the JPMorgan Nasdaq Fairness Premium Earnings ETF would possibly underperform the S&P 500, it may develop right into a hyper-effective supply of money payouts in the long run. When you’ve got $2,000 out there to start out a place at this time, this fund may pay out dividends approaching $1,317 in 2044. That is an efficient yield of 66%, although it may very well be greater or decrease relying on how correct my assumptions are.

At that time, the value per share will not actually matter anymore. You’d by no means promote any a part of that high-powered money machine until you completely needed to.

JPMorgan Chase is an promoting accomplice of Motley Idiot Cash. Anders Bylund has positions in Vanguard S&P 500 ETF. The Motley Idiot has positions in and recommends JPMorgan Chase and Vanguard S&P 500 ETF. The Motley Idiot has a disclosure coverage.