This firm is important to the way forward for synthetic intelligence, nevertheless it’s not eligible for the S&P 500.

Top-of-the-line methods to put money into the inventory market is to purchase an S&P 500 index fund. Shopping for an index fund ensures a diversified portfolio, so that you’re positive to personal a minimum of a small piece of the largest winners out there. And since only a handful of corporations drive nearly all of whole returns for the index every year, it is crucial that you simply personal shares in these corporations to supply good returns.

The most important winners within the inventory market over the previous two years have been synthetic intelligence (AI) shares. Corporations like Nvidia, Apple, and Meta have been a number of the largest contributors to the S&P 500’s returns in 2024. Should you personal an S&P 500 index fund, you personal an excellent quantity of every of these mega-cap shares.

Nevertheless, the S&P 500 would not embody each firm benefiting from elevated spending on synthetic intelligence. The index solely consists of persistently worthwhile U.S.-based corporations. In consequence, traders centered solely on an S&P 500 index fund can miss out on a number of the largest winners.

Since there are not any non-U.S. corporations within the S&P 500, index traders could also be lacking out on an amazing firm that is instrumental to the development in AI. Dutch firm ASML (ASML 2.18%) would not qualify for the S&P 500, however traders should not overlook the semiconductor inventory. The excellent news is that it is not too late to purchase shares.

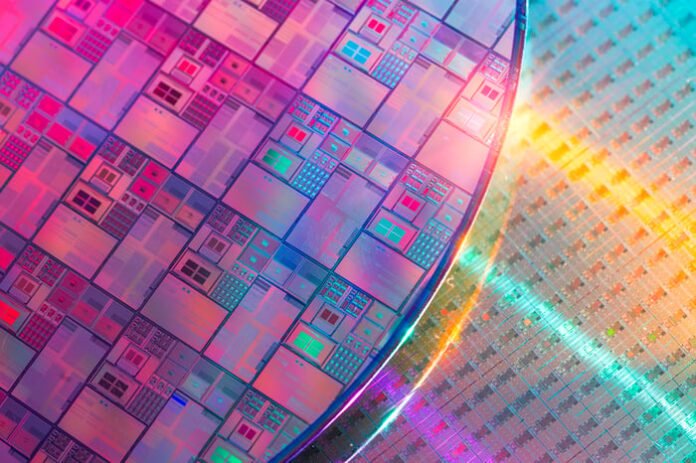

Picture supply: Getty Photographs.

Important equipment for the AI growth

ASML would not make semiconductors itself. As a substitute, it supplies key equipment that permits foundries to take advantage of its restricted sources. ASML sells semiconductor lithography machines, particularly deep ultraviolet (DUV) and excessive ultraviolet (EUV) machines. These machines permit foundries to print chip patterns on silicon wafers with low error charges.

ASML is the one firm producing EUV machines, that are obligatory for printing essentially the most superior AI chips. As massive tech corporations construct out large knowledge facilities centered on coaching and working generative AI fashions, they’ve quite a few constraints to contemplate. Two of the largest are area and vitality consumption. Extra environment friendly chips remedy that drawback, however creating essentially the most highly effective and power-efficient chips requires ASML’s machines.

The long-term outlook for the corporate is extraordinarily sturdy. Administration expects semiconductor gross sales for knowledge facilities to develop to $350 billion by 2030 on the again of elevated funding in AI. General semiconductor gross sales may prime $1 trillion that 12 months. That represents 9% common annual progress via the tip of the last decade.

Importantly, ASML ought to develop even sooner than the general semiconductor market. That is primarily as a result of there is no actual competitor for its machines. Moreover, its established relationships with the biggest foundries on the earth are unlikely to alter. It takes years of lead time to plan for a brand new machine, and current machines have a lifespan of 20 to 30 years, so ASML’s presence within the prime foundry amenities is more likely to stay a relentless for the foreseeable future.

On prime of that, ASML’s EUV machines are extra advanced than its DUV machines. In consequence, ASML will doubtless generate extra income from servicing its machines going ahead. That might additionally result in increased gross margins over the long term.

Top-of-the-line values in synthetic intelligence

ASML has been overwhelmed down within the second half of 2024, because it takes longer to get better from the gross sales slowdown within the again half of 2022. Administration narrowed its 2025 income steerage to between 30 billion euros and 35 billion euros ($31.1 billion to $36.3 billion), which is the underside half of its earlier expectations offered throughout its 2022 analyst day. It additionally lowered its gross margin expectations for subsequent 12 months to between 51% to 53%.

Buyers keen to take a look at ASML’s long-term potential may have an absolute discount on their arms. As talked about, ASML ought to outpace the 9% progress in semiconductor spending attributable to its sturdy aggressive place. Low double-digit income progress, mixed with sturdy working leverage from elevated EUV gross sales and repair income, ought to result in appreciable progress in working earnings over the following half-decade.

Administration forecasts 22.1 billion euros ($22.9 billion) in working earnings on the midpoint of its 2030 outlook. That is up from 8.8 billion euros ($9.1 billion) this 12 months. That is a mean compound annual progress charge of about 17% via the tip of the last decade.

Shares presently commerce for round 30 instances analysts’ consensus 2025 earnings estimate. That worth seems excessive because of the low expectations for 2025. However traders who see the long-term potential for ASML, as semiconductor gross sales increase over the remainder of the last decade, see the actual worth of the inventory as a lot increased.

Should you’ve caught with an S&P 500 index fund, you would possibly take into account including a small quantity of ASML. If it have been a part of the index, it might have a weighting of about 0.5%. That could be an excellent place to start out.

Even in case you aren’t an index investor, ASML could also be price a more in-depth look. It might be a terrific addition to any portfolio.

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Adam Levy has positions in Apple and Meta Platforms. The Motley Idiot has positions in and recommends ASML, Apple, Meta Platforms, and Nvidia. The Motley Idiot has a disclosure coverage.