Investing within the S&P 500 (^GSPC 1.09%) has traditionally been a good way for somebody to develop their wealth. As a benchmark for the broad market, the index tracks 500 of the most important and most profitable U.S. firms.

Whilst you can not make investments instantly within the S&P 500, a lot of exchange-traded funds (ETFs) observe the index at a low price. And since these ETFs distribute your cash throughout lots of of shares, a wager on the S&P 500 is usually a lower-risk approach to put money into the inventory market than choosing and selecting particular person shares.

It could not at all times be potential to place an enormous lump sum into the inventory market. Nevertheless, for those who come into an inheritance or revenue from the sale of a house, you could possibly make a large funding, even when you have not collected a major quantity of financial savings.

Beneath, I am going to have a look at whether or not investing $50,000 into an S&P 500 index fund can set you up on a path to have $1 million by retirement, a objective many individuals have with a purpose to stay comfortably of their golden years.

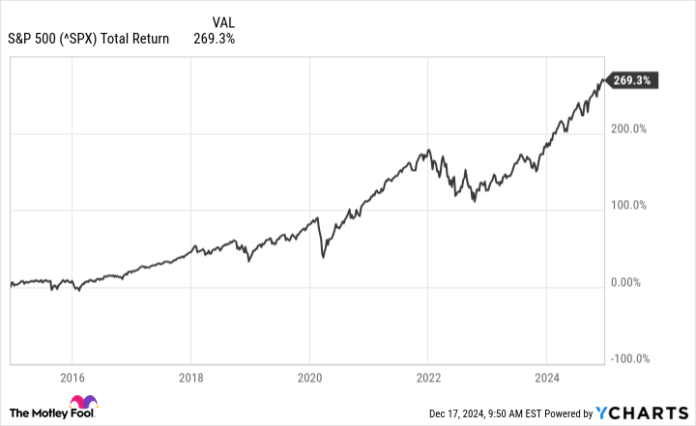

The S&P 500 has produced unimaginable returns over the previous decade

Going again practically a century, the compounded annual return for the S&P 500, together with dividends, is 10.1%. However prior to now 10 years, the index’s return has been an much more spectacular 13.7%. Whereas that is nice information for buyers who’ve been invested throughout that point, the outlook for the subsequent decade will not be so rosy.

Goldman Sachs analysts, for instance, venture the S&P 500 might solely generate a median annual return of three% over the subsequent 10 years resulting from excessive valuations and the ensuing focus of worth within the index’s largest holdings. JPMorgan analysts consider the index will ship an annual return of simply 6% over the subsequent decade.

Put merely, investing within the index right now may imply considerably decrease returns than what buyers have grown used to in latest historical past.

Knowledge by YCharts.

However for somebody beginning their profession or in the course of it, investing their retirement financial savings means considering past the subsequent decade. So, even when the subsequent 5 or 10 years of returns for the index are comparatively weak, the S&P 500 may nonetheless make up for these sluggish years with higher returns down the street. There are simply too many components that might weigh on the markets, making it subsequent to not possible to foretell precisely what the market will try this a few years sooner or later.

Here is how a lot a $50,000 funding may turn into

As an alternative of attempting to guess precisely what the annual returns for the S&P 500 might be over the subsequent decade and past, the desk under illustrates what a $50,000 funding may very well be price beneath completely different eventualities.

|

Projected Worth of a $50,000 Funding In the present day |

||||

|---|---|---|---|---|

|

Annualized Fee of Return for the S&P 500 |

||||

| Yr | 3% | 6% | 8% | 10% |

| 10 | $67,200 | $89,500 | $107,900 | $129,700 |

| 20 | $90,300 | $160,400 | $233,000 | $336,400 |

| 25 | $104,700 | $214,600 | $342,400 | $541,700 |

| 30 | $121,400 | $287,200 | $503,100 | $872,500 |

| 35 | $140,700 | $384,300 | $739,300 | $1,405,100 |

| 40 | $163,100 | $514,300 | $1,086,200 | $2,263,000 |

Desk and calculations by writer. Quantities rounded to the closest hundred.

The fact is that whereas a $50,000 lump funding could also be a major amount of cash, it would nonetheless take a few years and a stable charge of return to develop to $1 million.

A technique to assist enhance these numbers is by contributing to your holdings over time. Even for those who’re in a position to put a big lump sum into the inventory market right now, periodically including to your portfolio may be an efficient method to assist speed up your positive factors.

Sluggish and regular wins the race

Chances are you’ll have a look at the desk above and suppose it is not price investing within the S&P 500 if its returns might diminish within the years forward. Or it’s possible you’ll consider you are higher off prioritizing different investments like development shares. Simply keep in mind that the potential for greater returns additionally means taking over extra danger, and never everyone seems to be snug with the additional volatility that comes with such an method.

In the meantime, a wager on the S&P 500 provides fast diversification, and its concentrate on massive, high-quality companies nonetheless makes it some of the dependable methods to put money into the inventory market. However even you probably have $50,000 to start your journey, persistence is important to present your funding the time it must develop into a correct nest egg.

JPMorgan Chase is an promoting associate of Motley Idiot Cash. David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Goldman Sachs Group and JPMorgan Chase. The Motley Idiot has a disclosure coverage.