There are greater than 300 million customers around the globe who use Amazon (AMZN -2.22%). The corporate’s e-commerce platform is the go-to possibility for a lot of prospects seeking to purchase issues on-line. And with next-day and even same-day supply choices, it might typically be far more handy than going to an in-store retailer.

However Amazon is not capturing the entire market and catering to all buyer wants. There are a lot of shoppers who want to get monetary savings amid inflation, and turning to cheaper on-line retailers resembling Temu or Shein. They’re keen to attend longer for purchases if it means a a lot cheaper price level for merchandise.

Amazon, nonetheless, goes to concentrate on these forms of prospects with the launch of its latest service: Amazon Haul.

What’s Amazon Haul?

Amazon Haul is a brand new storefront that may provide discounted objects to raised compete in opposition to Temu, Shein, and different e-commerce platforms that provide ultra-low-priced merchandise. It guarantees to have objects which might be $20 or much less, however most will probably be lower than $10 and a few as little as simply $1. The caveat is that similar to with these different low-priced websites, delivery speeds is probably not quick and might take as much as two weeks.

Shoppers, nonetheless, have proven that quick delivery speeds aren’t essential, particularly when it means they will save much more on their purchases. By providing a lower-priced storefront possibility, Amazon can attain a broader buyer base and probably unlock an enormous development catalyst for its operations.

Amazon Haul will initially be obtainable to U.S. prospects, and will probably be accessible as soon as customers replace the Amazon Procuring app. The corporate says it plans to innovate and refine this providing additional as it should search for suggestions from buyers.

Amazon’s development charge might use a lift

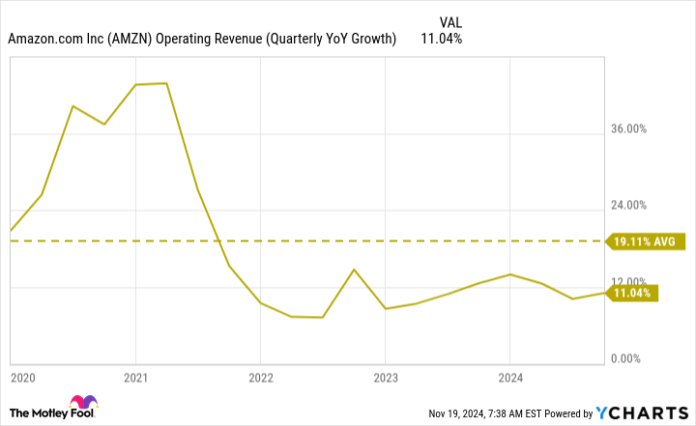

Amazon has generated regular development in current quarters however there’s positively been a slowdown in contrast with the early phases of the pandemic when folks have been spending extra time at residence and shopping for loads of items on-line.

AMZN Working Income (Quarterly YoY Progress) information by YCharts

PDD Holdings, the corporate that owns Temu, has benefited from a a lot quicker development charge, by comparability. Throughout the first six months of the yr, the corporate’s income doubled to $25.3 billion. PDD Holdings owns Temu and Pinduoduo, one other in style e-commerce website that focuses on agriculture. Shein is not a public firm, so its numbers aren’t publicly obtainable. Some estimates, nonetheless, have pegged the corporate’s 2023 gross sales at round $32.5 billion.

The launch of Amazon Haul ought to enable Amazon to chip away at a few of the unimaginable development these websites have been capable of generate.

Does this transfer make Amazon a no brainer purchase?

Amazon’s inventory trades at greater than 40 occasions earnings and coming into buying and selling on Tuesday, it was up greater than 32% for the reason that begin of the yr. It is a prime e-commerce inventory to personal however it’s not a very low-cost one, with a market cap of $2.1 trillion.

If Amazon Haul proves to be a formidable possibility for patrons wanting to economize and who could have in any other case gone to Temu or Shein, then that may enhance not simply Amazon’s top-line development, but in addition its backside line, leading to a extra engaging earnings a number of and valuation.

General, this seems to be like a terrific transfer for Amazon and I believe it might make the inventory a significantly better purchase. It might take some time for Amazon to fine-tune the brand new service, however with the corporate’s concentrate on the client and searching for methods to make issues higher, I am assured the tip end result will probably be a extremely aggressive service. And that will probably be an enormous win for each buyers and prospects, because it might carry far more visitors onto Amazon’s platform.

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon. The Motley Idiot has a disclosure coverage.