The e-commerce firm’s heavy spending will not final eternally, however the development it produces will.

There is not any denying that traders have been lower than thrilled with the third-quarter outcomes MercadoLibre (MELI 4.76%) posted final week. Shares tumbled greater than 16% on Thursday alone in response to the numbers, and are nonetheless properly down from the pre-earnings peak on the time of this writing.

For traders who can look previous all of the post-earnings noise, nevertheless, this pullback is a shopping for alternative. The market’s ignoring an vital element concerning its current (and near-future) outcomes.

Large spending takes a chunk out of earnings

MercadoLibre missed its earnings estimates by a rustic mile, reporting a per-share revenue of $7.83 versus a consensus estimate of $10. Though gross sales grew a agency 37% 12 months over 12 months and per-share revenue edged just a little greater, it simply wasn’t sufficient. Hovering spending that led to a marked decline in working revenue simply rattled traders — and understandably so.

There’s extra to the story, although.

On the off-chance you are studying this and are not acquainted with it, MercadoLibre is an e-commerce identify serving the South American market. It is also known as the Amazon of Latin America, in reality, though that is removed from a whole description. It is also akin to eBay, Shopify, and PayPal in that it permits prospects to function their very own on-line shops, and course of on-line funds. Certainly, MercadoLibre processed $50.7 billion price of funds within the third quarter alone, up 34% from year-earlier ranges.

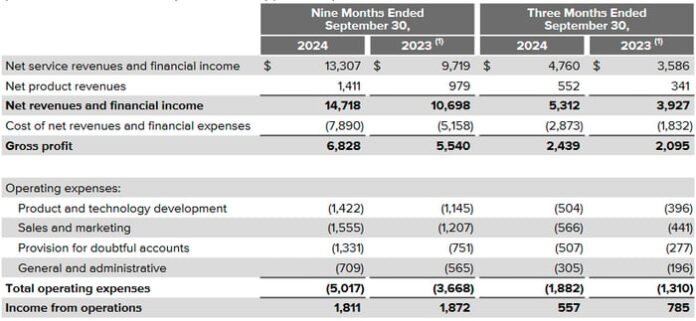

The issue? Spending. There’s an excessive amount of of it. Because the picture under illustrates, spending on every thing from analysis and growth to advertising and marketing to administration was up. The corporate’s “value of internet income and monetary bills” additionally grew excess of its high line did. Maybe most alarming of all, MercadoLibre’s provision for credit score losses practically doubled, because the group makes a concerted level of increasing its bank card enterprise. Add all of it up, and working revenue really fell 29% through the three-month stretch ending in September.

Picture supply: MercadoLibre’s fiscal Q3 2024 investor report.

The factor is, this was all the time the plan. And the plan is paying off. It is simply not evident that it is paying off but.

MercadoLibre is investing in development

In easy phrases, MercadoLibre is capitalizing on the expansion alternative at hand.

In lots of (though not all) methods, the place South and Latin America are actually is the place North America was 20 years in the past. Smartphone adoption there has exploded in simply the previous few years, as an example. Whereas Pew Analysis stories that 90% of adults residing in the US now personal smartphones, market analysis outfit GSMA says Latin America’s smartphone penetration fee was solely 69% in 2021, en path to a still-modest prediction of 74% by 2025.

One key distinction between the areas: Latin America is a “cell first” market, which means that for most individuals, their main connection to the world through the web comes from their cell phone quite than a house pc.

No matter how they are going on-line, they are going on-line – and what they’re doing as soon as they’re on-line is not stunning.

As was the case within the U.S., on-line procuring and on-line banking are exploding in Latin America. Americas Markets Intelligence believes the area’s e-commerce trade is ready to develop 24% this 12 months, and broaden by 21% subsequent 12 months and one other 21% the 12 months after that. On-line banking is following swimsuit, with Technavio saying Latin America’s banking-as-a-service market is poised for annualized development of 20% between now and the tip of 2028.

Plugging into this chance takes cash, although … which traders appear to have forgotten. As MercadoLibre’s CFO Martin de los Santos informed Reuters: “What in all probability occurred is that the market did underestimate the quantity of investments we’re doing in bank card.”

Now take one other take a look at the snapshot of final quarter’s revenue assertion above. MercadoLibre is clearly spending extra on development. It has been doing so all 12 months lengthy, in reality, even when Q3’s ramp-up in outlays accelerated its earlier spending development. However this elevated spending is paying off. Though it is not but boosted internet earnings, it’s boosting income. As soon as extra customers and company shoppers are on board, the earnings will come. That is the phrase from the analyst group, anyway. It expects this firm’s per-share revenue to greater than triple final 12 months’s tally by 2026.

Information supply: StockAnalysis.com. Chart by writer.

Nonetheless extra to love than not, together with the inventory’s value

There are not any ensures, in fact. The Latin American on-line banking and fee market might show surprisingly aggressive, with rivals like Nu approaching sturdy. Extra competitors means extra spending is required.

Have a look at the larger image, although. There’s sufficient development in retailer to go round. Furthermore, because the area’s on-line fee and e-commerce companies mature and persons are extra acquainted with each, MercadoLibre will really be capable of spend comparatively much less on advertising and marketing and product growth. Final quarter’s large bounce in loan-loss provisions can also be extra of an outlier than not, stemming from the corporate’s hyper-aggressive efforts to broaden its bank card enterprise.

In different phrases, this firm’s current outcomes aren’t indicative of its probably future. They’re the growth-driving exception to the larger development. Final week’s tumble is a shopping for alternative.

This may assist: Analysts’ present consensus value goal of $2,381.29 is greater than 30% above the inventory’s current value (as of this writing). The overwhelming majority of this crowd additionally considers MercadoLibre a powerful purchase at the moment, shrugging off final quarter’s disappointing earnings and the next setback for MELI inventory. They’re clearly seeing one thing the typical investor has seemingly overpassed in the meanwhile.

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. James Brumley has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, MercadoLibre, PayPal, and Shopify. The Motley Idiot recommends Nu Holdings and eBay and recommends the next choices: lengthy January 2027 $42.50 calls on PayPal and quick December 2024 $70 calls on PayPal. The Motley Idiot has a disclosure coverage.