Shares on this EV maker are dust low-cost. Is it time to purchase?

When on the lookout for a inventory with millionaire-maker potential, I sometimes gravitate towards firms with small valuations, fast development, and a pathway to profitability. With shares down by a whopping 97% from their all-time excessive of $58 (reached in early 2021), Lucid Group (LCID -0.45%) meets at the least one among these standards. However what concerning the others? Let’s dig deeper into the professionals and cons of this embattled electrical automaker.

What occurred to Lucid’s outdated purchase thesis?

When Lucid hit the market in 2021, electrical autos (EVs) have been the newest expertise hype — arguably capturing the identical stage of pleasure as synthetic intelligence in the present day. The trade chief, Tesla, had not too long ago develop into worthwhile. And legacy automakers like Ford Motor Firm and Normal Motors introduced plans to shift capital expenditure to the brand new alternative.

On the time, Lucid appeared poised to fill a spot out there. Like Tesla, it was a contemporary, pure-play EV model with out a lot baggage. Nevertheless, it differentiated itself by specializing in the ultra-luxury EV market with its first providing, the Lucid Air, which led the trade when it comes to vary, energy, and inside end.

Quick-forward to 2024, and the EV panorama seems to be radically completely different. For starters, development has shifted away from pure-play EV makers to legacy automakers, which appear to be leveraging their extra established manufacturers, distribution, and repair networks to drive client adoption. Most alarmingly, the posh section is getting crowded, with manufacturers like Cadillac and Mercedez-Benz pouring into the market.

Can Lucid win the posh battle?

Lucid’s third-quarter earnings present a glimmer of hope. Car deliveries jumped 91% 12 months over 12 months to 2,781, whereas the corporate’s income elevated 45% to $200 million. Administration expects to spice up development even additional with its newest providing, the brand new Lucid Gravity SUV, which is anticipated to begin manufacturing this 12 months.

SUVs and crossovers are surging in recognition relative to sedans in North America. And the Gravity might be key to Lucid’s survival — permitting it to develop right into a bigger and probably profitable market section the place related merchandise, such because the $58,900 (base) Cadillac Lyric, have seen huge success (with third-quarter gross sales up 139% to round 7,000 models).

Lucid is taking pre-orders for the Gravity at a whopping $94,900 for the “Grand Touring” trim. The extra reasonably priced “Touring” trim will begin at $79,900 when it turns into out there in late 2025.

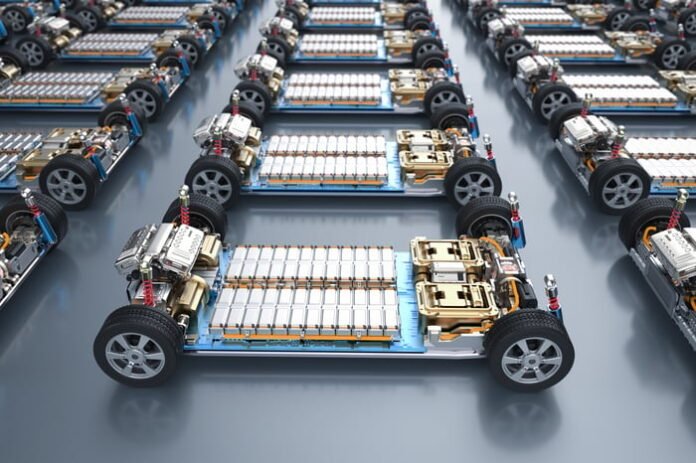

Picture supply: Getty Photographs.

Lucid should justify its large pricing with efficiency and options. Nevertheless, the excellent news is that the Gravity Grand Touring could have a variety of 440 miles and 828 horsepower — considerably greater than the top-trim Cadillac Lyriq, which has a variety of 314 miles and 500 horsepower.

Is Lucid Group a millionaire-maker inventory?

Danger and reward typically go hand in hand. And though Lucid has nice potential, there are additionally some crimson flags buyers ought to watch. Money burn might be the largest of those long-term challenges.

Within the third quarter, Lucid generated an working lack of $771 million. Extrapolated over 4 quarters, that might translate to an annualized money burn of over $3 billion — an eyewatering outflow contemplating the corporate solely experiences $1.9 billion in money and equivalents on its steadiness sheet. Buyers ought to count on extra fairness dilution as Lucid points and sells extra shares to boost the cash wanted to take care of its operations.

Whereas Lucid’s small dimension and large development alternative give it millionaire-maker potential over the long run, the corporate appears method too dangerous to guess on proper now, contemplating its money burn and the specter of dilution.

Will Ebiefung has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot recommends Normal Motors and recommends the next choices: lengthy January 2025 $25 calls on Normal Motors. The Motley Idiot has a disclosure coverage.