This small-cap inventory has skyrocketed after posting a stunning revenue within the third quarter.

The inventory market has soared larger in 2024, with the S&P 500 index up 21%. Towards this backdrop, Root Inc. (ROOT 3.94%) has emerged as a breakout inventory. This firm is not simply driving the wave of progress — it is making waves of its personal, with the replenish greater than 600% because the starting of the 12 months.

Traders had been pleasantly shocked when the corporate introduced its first worthwhile quarter since going public, one thing few anticipated. In case you’re pondering of investing on this revolutionary progress inventory at present, contemplate the next.

Root shocked buyers with its third-quarter revenue

Root is a tech-driven automotive insurance coverage firm that has gone on an absolute tear. The small firm began the 12 months with a bang when it posted better-than-expected income and earnings per share measures throughout its February earnings name. The inventory went from $9 earlier than the earnings report to just about $84 within the weeks that adopted.

The corporate acknowledged that its path to profitability was turning into extra seen, which kicked off the inventory’s sharp rally. Now, buyers are starting to see that imaginative and prescient develop into a actuality.

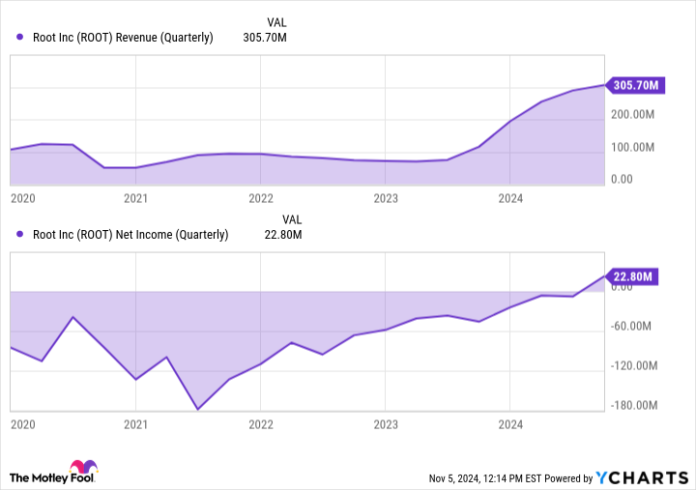

Root shocked buyers when it introduced its third-quarter outcomes on Oct. 30. The corporate posted internet revenue of $22.8 million, or earnings per share (EPS) of $1.35, effectively above analysts’ forecasts of a loss per share of $0.98.

Within the third quarter, Root’s internet premiums earned had been $279 million, representing progress of 180% from one 12 months in the past. Via the primary three quarters of 2024, Root’s premiums earned are $771 million, a 244% enhance from final 12 months.

ROOT Income (Quarterly) information by YCharts

Root has made eye-opening progress

Relating to up-and-coming insurance coverage corporations, fast progress tends to come back at the price of rising claims prices and bills. Nevertheless, this hasn’t been the case with Root this 12 months. The corporate has skilled stellar income progress and is managing bills and protecting claims prices in examine.

On the core of Root’s enterprise is expertise and information science. The corporate leverages driver conduct collected by way of its app, together with velocity, mileage pushed, braking time, and different info. From there, it could actually use that information to cost its insurance policies. Chief Govt Officer Alex Timm instructed buyers: “We’re consistently iterating on and innovating on what we consider to be one of many quickest paces within the trade.”

One essential measure for insurers is the mixed ratio, which is the ratio of claims prices plus bills divided by premiums earned. A measure under 100% means an insurer is profitably underwriting insurance policies, and the decrease the ratio, the extra worthwhile it’s.

Root’s mixed ratio was a stellar 91.1% within the third quarter. This not solely rivals Progressive, one of many high auto insurers on the market, nevertheless it was an enormous enchancment from one 12 months in the past when its quarterly mixed ratio was 143%. Via the primary three quarters of this 12 months, Root’s mixed ratio is 98.3%.

Picture supply: Getty Photos.

Is Root inventory best for you?

Root posted a wonderful quarterly earnings report and has overwhelmed analysts’ estimates a number of quarters in a row. As a potential investor, I discover that progress encouraging, however I need to see if Root’s stellar underwriting and coverage progress can proceed throughout totally different pricing environments.

Final 12 months, Root struggled alongside the whole property and casualty (P&C) trade, which had a mixed lack of $24 billion in 2023. Issues have improved throughout the trade; in 2024, P&C insurers have made a $3.8 billion underwriting achieve, which has undoubtedly been a tailwind for insurers like Root.

Traders who purchase the inventory ought to concentrate on its excessive volatility. Beta measures a inventory’s danger relative to the market (with the S&P 500 as a generally used benchmark). Shares with a beta of lower than 1 are thought-about much less unstable than the market, whereas a better beta signifies a extra unstable inventory. Root’s beta is 3.5, that means it’s 250% extra unstable than the S&P 500.

Most buyers might need to keep away from this extremely unstable inventory and will contemplate investing in steady, established corporations with lengthy monitor information of success, like Progressive or Chubb. Nevertheless, buyers with a excessive danger tolerance and on the lookout for revolutionary disruptors may even see Root’s substantial progress as a inexperienced gentle to purchase at present.