Cava has a whole lot of potential to get larger sooner or later, however are buyers already pricing in a whole lot of that development?

One of many hottest meals shares to personal this 12 months has been that of Cava Group (CAVA -0.19%). The Mediterranean restaurant chain went public final 12 months, and whereas it did not get off to a fantastic begin, 2024 has been a a lot better 12 months for the inventory. Yr thus far, Cava’s valuation has risen by greater than 220%, and it is at the moment buying and selling round its 52-week excessive.

What’s behind the inventory’s spectacular rally, and is Cava nonetheless a fantastic purchase at this time?

Cava has been an unstoppable development machine

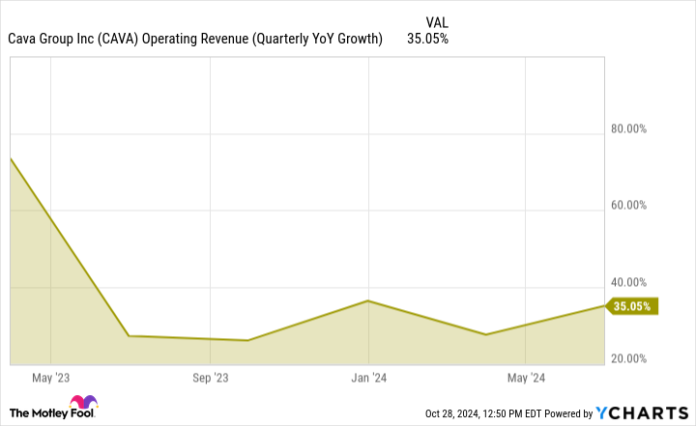

A giant purpose Cava is ready to entice a whole lot of development buyers is because of the spectacular development numbers it generates. Not solely is the corporate rising organically, it is also aggressively launching extra places to unfold its attain and penetrate new markets. And though its development fee has slowed down from the monstrous ranges it was at a 12 months in the past, the enterprise’ gross sales are nonetheless increasing by greater than 35%.

CAVA Working Income (Quarterly YoY Progress) knowledge by YCharts.

What’s extra spectacular, nevertheless, is that the corporate is not simply benefiting from the launch of recent shops — it is also delivering sturdy natural numbers. For the interval ending July 14, Cava reported identical restaurant retailer gross sales development of 14.4%. This determine merely takes under consideration the identical eating places that had been opened a 12 months in the past. Many eating places generate comparable gross sales development that is in single digits, and Cava’s capability to extend at nicely into double digits is an encouraging signal that its eating places are proving to be in style.

The corporate can be increasing its footprint. As of the top of the quarter, its restaurant rely was as much as 341, which is a 22% improve from a 12 months in the past.

Is Cava’s inventory too costly?

There is not any doubt that Cava makes for a fantastic development inventory nowadays, however the large query is whether or not the premium buyers are paying for it is just too excessive. A strategy to evaluate it’s with respect to income and earnings. Here is the way it stands up in opposition to Chipotle Mexican Grill, a prime restaurant inventory buyers usually evaluate it to.

CAVA PE Ratio knowledge by YCharts. PE = price-to-earnings. PS = price-to-sales.

In comparison by each income and earnings, buyers are paying a far larger a number of for Cava Group. The counterpoint could be that Cava is at a a lot earlier stage in its development than Chipotle is, and thus, the next a number of could also be justifiable. However given Cava’s surging valuation in latest months, I would argue that the hole is maybe too vast proper now on each of those metrics.

Do you have to purchase Cava Group inventory?

I am optimistic that Cava can nonetheless proceed to develop in worth in the long term because it invests in additional development alternatives. However its steep valuation means that a whole lot of future development is already priced into the inventory’s worth at this time. The hazard for buyers is that purchasing at such a excessive worth might restrict your potential to earn a big return from the inventory down the highway.

Whereas the inventory might rise larger within the close to future — particularly if its upcoming quarterly outcomes are sturdy but once more — buyers might wish to mood their expectations, as this is not an inexpensive funding to personal. I am undecided how a lot larger the inventory might go, however Cava might attain a peak sooner somewhat than later. Given its excessive worth, buyers could also be higher off pursuing different development shares as an alternative.

David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Chipotle Mexican Grill. The Motley Idiot recommends Cava Group and recommends the next choices: brief December 2024 $54 places on Chipotle Mexican Grill. The Motley Idiot has a disclosure coverage.