This firm is perhaps value way over many notice.

If I had to purchase one share of any biotech with no worth restriction, I might naturally gravitate towards essentially the most profitable corporations within the business. Nonetheless, the train turns into extra sophisticated when you stipulate a restrict of $50 per share; a lot of the distinguished biotech shares are buying and selling nicely above that quantity.

These round that stage are, disproportionately, comparatively small and dangerous corporations whose prospects do not look all that robust. Nonetheless, at the least one biotech firm whose shares are under $50 seems like a fantastic purchase: CRISPR Therapeutics (CRSP -1.23%).

What occurred to CRISPR Therapeutics?

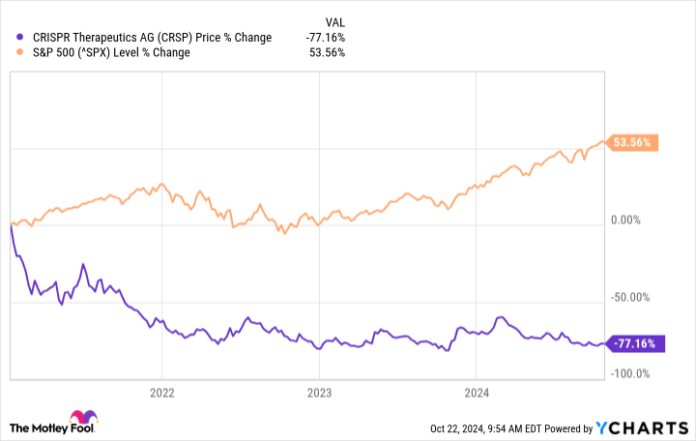

CRISPR Therapeutics merely hasn’t been a favourite amongst buyers previously three-and-a-half years. Its inventory is down by 77% since mid-January 2021:

A minimum of two elements have led to CRISPR Therapeutics’ poor efficiency.

First, the corporate is not worthwhile. That is fairly regular for a mid-cap biotech, however with rising rates of interest, buyers needed to place their cash into safer, worthwhile investments. Loads of worthwhile corporations have been transferring within the unsuitable route over the previous few years.

Second, CRISPR focuses on gene modifying. Though the know-how has the potential to unlock therapies for ailments we beforehand could not remedy, it has one main disadvantage. Ex vivo gene-editing medicines are complicated to manage — the method takes some time and might solely be executed in specialised remedy facilities.

Primary finance tells us that the extra we lengthen the timing of future money move we’ll obtain for an asset, the much less it is value in the present day, all else being equal. The method concerned in administering the sorts of therapies developed by CRISPR Therapeutics lengthens the timing of their future money move in comparison with easy oral drugs.

Many buyers see important dangers in investing within the firm due to its gene-editing focus. Living proof: Bluebird Bio is a biotech firm with three permitted gene-editing therapies, however its inventory continues to carry out terribly. Income is not coming quick sufficient for buyers to vary their opinion of Bluebird. Is identical destiny awaiting CRISPR Therapeutics?

Why the inventory remains to be value investing in

The problem for CRISPR Therapeutics is threefold. First, it must develop profitable therapies; that is onerous sufficient, however particularly so in gene modifying. Second, the biotech has to fund commercialization efforts till the income from its therapies covers — and exceeds — the related bills. Third, it has to pour extra money into analysis and improvement to create newer medicines.

How is the corporate managing? On the primary entrance, it earned approval for Casgevy, a remedy for sickle cell illness and beta-thalassemia (each uncommon blood ailments), final 12 months. Casgevy was the primary permitted gene-editing drugs that makes use of the Nobel Prize-winning CRISPR method.

Though CRISPR Therapeutics seems like an progressive firm, as with Bluebird, that alone just isn’t sufficient. Fortunately, administration had the foresight to companion with a biotech big, Vertex Prescribed drugs, to develop Casgevy. The partnership considerably lowered the chance related to CRISPR Therapeutics’ improvement of the medication. The mid-cap biotech has already acquired up-front funds from Vertex for a few of the rights (60%) to Casgevy’s income.

CRISPR Therapeutics may even profit from Vertex’s experience in negotiating with third-party payers and its important footprints within the business, which can assist with commercialization and advertising and marketing efforts. Moreover, Casgevy has earned approval not simply within the U.S. but in addition in Europe, Saudi Arabia, and Bahrain. Had CRISPR Therapeutics been engaged on this program by itself, it would not have earned the nod for Casgevy in Europe that quick. And it in all probability would have by no means sought approval within the two Center Japanese international locations; mixed, they’ve a goal affected person inhabitants of 23,000 individuals, greater than the U.S. does.

With Vertex’s assist, CRISPR Therapeutics ought to achieve sustaining commercialization efforts till Casgevy’s income begins ramping up. And at $2.2 million per remedy course within the U.S., an addressable market of about 58,000 sufferers, and little to no competitors to talk of (particularly outdoors the U.S.), the remedy has blockbuster potential.

As of June 30, CRISPR Therapeutics had $2 billion in money and equivalents, a major quantity for a corporation with a market capitalization of simply $4.1 billion.

The biotech has 5 different promising therapies in improvement throughout varied areas. For my part, the market is undervaluing Casgevy’s potential and that of CRISPR Therapeutics’ complete platform.

For simply $50 (or a bit over $48 as of this writing), it is onerous to discover a higher biotech inventory — particularly one that would ship outsized returns — to purchase and maintain for some time.