Buyers will need to contemplate the next earlier than selecting up this ultra-high yield dividend inventory.

Many earnings buyers could also be drawn to Annaly Capital Administration (NLY -1.11%) due to its eye-popping dividend, which on the present share worth yields greater than 13%.

Like many actual property funding trusts (REITs), Annaly Capital struggled on account of rising rates of interest previously few years. Nonetheless, the tides could also be shifting: In September, the Federal Reserve minimize its benchmark rate of interest for the primary time since 2020. Many market members anticipate that the central financial institution will proceed reducing rates of interest so long as inflationary pressures subside.

With rates of interest forecast to fall, Annaly Capital may very well be an interesting funding immediately whereas it is nonetheless buying and selling beneath $21 per share. However there are some issues that long-term buyers will need to contemplate first.

Here is how Annaly makes cash

REITs give buyers actual property market publicity, and in addition supply engaging dividend yields, making them notably interesting to income-focused buyers. Most of them make investments straight in leased properties equivalent to retail facilities, multifamily housing, knowledge facilities, or warehouses.

Not like most REITs, Annaly Capital does not handle a portfolio of properties. It’s a mortgage actual property funding belief (mREIT), so it invests in mortgage-backed securities — swimming pools of residential mortgages which might be bundled and offered to buyers. It invests largely in what are referred to as company mortgage-backed securities — property created by government-sponsored entities such because the Federal Nationwide Mortgage Affiliation (Fannie Mae) and the Federal House Mortgage Mortgage Company (Freddie Mac). These companies assure the principal and curiosity funds on these mortgage investments.

Mortgage yields alone aren’t very excessive, so Annaly makes use of borrowing by repurchase agreements or different monetary devices to spice up its returns. It goals to have an financial leverage ratio beneath 10. (That metric measures the ratio of its debt and derivatives divided by its whole fairness.)

What’s essential to grasp right here is that Annaly borrows capital on a short-term foundation by its monetary devices whereas investing in long-term mortgage-backed securities. Primarily, Annaly earns cash based mostly on the unfold between the yield on its property and the price of its borrowings. This makes it notably delicate to modifications within the yield curve, which is the connection between rates of interest and time to maturity for an asset.

A poor performer for buyers in recent times

Through the previous couple of years, rates of interest throughout the yield curve have risen. On one hand, Annaly benefited because the yields on its interest-earning property elevated to 4.33%. Nonetheless, the typical value of its liabilities additionally elevated from 0.79% two years in the past to three.01% final yr. Because of this, its internet curiosity unfold narrowed from 1.89% in 2021 to 1.32% in 2023.

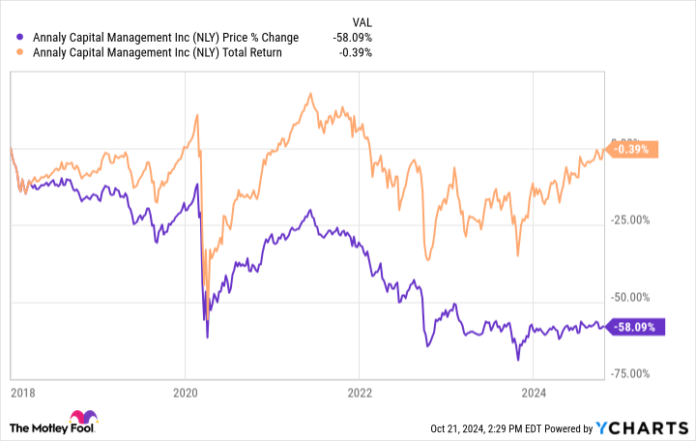

Annaly’s sensitivity to rates of interest has been particularly noticeable the previous couple of rate of interest cycles, beginning in 2018 when the Federal Reserve started to lift charges. Since then, the mREIT’s whole return (which incorporates reinvested dividends) has been unfavourable 0.4%. So, regardless of paying a dividend with a double-digit proportion yield, the worth of the inventory has fallen 58%, leading to a internet return of nearly nothing for buyers throughout that point.

Why Annaly Capital might do nicely within the brief time period

The easing of financial coverage in the course of the subsequent yr ought to profit Annaly. A steep yield curve with low short-term rates of interest and better long-term charges would let it borrow at decrease prices whereas investing in higher-yielding mortgage-backed securities. Its new investments in the course of the previous couple of years have raised its common asset yield from 2.61% in 2021 to five.17% on the finish of 2024’s second quarter.

Based on the CME FedWatch Instrument, market members are at present anticipating 1.5% value of rate of interest cuts in the course of the subsequent yr, and pricing the affect of these anticipated cuts into the values of assorted property. These cuts would enhance the guide worth of Annaly’s portfolio, so they might present a tailwind for inventory.

Nonetheless, longer-term elements might proceed to have an effect on rates of interest. For instance, JPMorgan Chase Chief Govt Officer Jamie Dimon has warned that rising fiscal deficits, international commerce restructuring, growing authorities obligations, and geopolitical uncertainty might make this decade extra risky than the earlier one. Because of this, buyers stay open to an setting the place rates of interest stay increased than they had been in the course of the 2010s.

Is it a purchase?

Annaly may very well be an interesting purchase for buyers who need to make a guess on falling rates of interest in the course of the subsequent couple of years. The mREIT ought to see its guide worth bounce again, which may very well be a tailwind for the inventory within the brief time period.

That stated, longer-term structural forces might end in increased rates of interest than have prevailed in latest many years, and Annaly’s sensitivity to the yield curve opens the chance that it could have to chop its dividend in some unspecified time in the future down the highway. For that purpose, long-term earnings buyers searching for dependable passive earnings could need to look elsewhere.

Courtney Carlsen has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.