The corporate might be giving an necessary replace to shareholders subsequent week.

The guts of earnings season is upon us. Firms are set to replace traders with their monetary outcomes for the third quarter over the following few weeks, and traders are certain to react…rationally. Jokes apart, there are occasions when a single earnings report may be given an excessive amount of significance from the funding neighborhood. It is a knowledge level, positive, however one which encapsulates solely a single three-month interval.

With that being stated, Amazon (AMZN -0.03%) might be releasing its earnings quickly. Buyers might be on the lookout for additional enhancements throughout its e-commerce, retail, and cloud computing divisions. The inventory is now up 123% for the reason that starting of 2023 and has a market capitalization of roughly $2 trillion.

Must you purchase Amazon inventory earlier than its earnings launch on Oct. 24?

Margin growth in retail

The unique Amazon enterprise — and nonetheless its largest — is its e-commerce and retail empire. In North America alone, income was $176 billion by means of the primary six months of 2024 and grew 9% 12 months over 12 months final quarter. Much more necessary than income development is revenue margin growth, which appears to be lastly exhibiting up for the e-commerce division.

Working revenue was $10 billion for North American retail within the first six months of 2024, which supplies a revenue margin of 5.6%. The determine is similar during the last 12 months and has been increasing for the final two years. With fast-growing promoting income, third-party vendor companies, and subscription income from Amazon Prime, the North American retail income combine has a lot better gross margins than 10 years in the past.

For the third quarter, traders ought to search for Amazon to maintain increasing its working revenue margin within the retail section. Over the following few years, it is not outrageous to anticipate this determine to hit 10% or larger, which may result in big development in revenue technology for the entire firm.

AWS income development

The second necessary division for the corporate is Amazon Internet Providers (AWS). The cloud computing chief brings in near $100 billion in annual income and sports activities excessive revenue margins (33.4% during the last 12 months). It is benefiting significantly from the growth in synthetic intelligence (AI), by which software program suppliers are turning to cloud infrastructure firms equivalent to AWS to energy their merchandise.

Buyers ought to monitor AWS and its continued income development acceleration within the third quarter. Income development has accelerated since Q2 of final 12 months, and hit 19% development final quarter. All indications are that this acceleration will proceed with booming spend for AI. Over the long run, there’s room for AWS to hit $200 billion or extra in annual income. With 30% revenue margins, that is quite a lot of money despatched as much as the guardian firm, which ought to make shareholders completely satisfied.

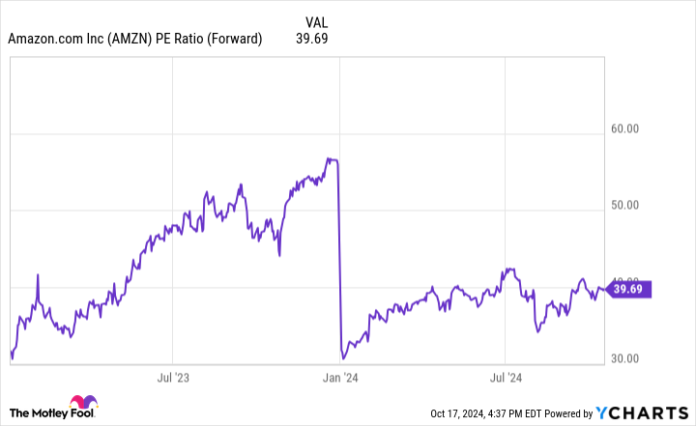

AMZN PE Ratio (Ahead) knowledge by YCharts.

Is the inventory a purchase?

Clearly, Amazon’s retail and cloud computing divisions are each doing nicely in the intervening time. Nonetheless, the inventory has mirrored this success, and is now at a market cap of round $2 trillion.

Based mostly on future earnings estimates, Amazon has a price-to-earnings (ahead P/E) ratio of slightly below 40, which is nicely above the typical for the S&P 500 index. However what about its earnings potential a number of years from now?

Over the past 12 months, Amazon’s consolidated working margin hit 9%, an all-time excessive. As AWS turns into a bigger a part of the enterprise and retail retains getting extra environment friendly, I consider that this consolidated revenue margin can develop to fifteen% in three years. If consolidated income can continue to grow at 10% a 12 months, the corporate might be producing round $800 billion in gross sales three years from now.

With $800 billion in gross sales, 15% margins would imply round $120 billion in annual earnings — or a P/E of roughly 17 primarily based on the inventory’s present market cap. That math says that Amazon is probably going buying and selling at a slight low cost, however just isn’t overly low cost at present. This is not shocking provided that the inventory is up over 100% for the reason that starting of 2023.

Maintain Amazon inventory in your watchlist earlier than this earnings report on October 24. This is not a screaming purchase at present.

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Brett Schafer has positions in Amazon. The Motley Idiot has positions in and recommends Amazon. The Motley Idiot has a disclosure coverage.