These vitality firms ought to be capable of proceed rising their enticing dividends.

The world will want much more vitality sooner or later. New applied sciences, inhabitants progress, and an increasing center class are all fueling the necessity for extra vitality. Whereas cleaner sources like renewables will seemingly provide a lot of this new capability, fossil fuels may also proceed taking part in an important function in fueling the worldwide financial system.

There are lots of methods to capitalize on the rising want for vitality. Brookfield Renewable (BEP 1.61%) (BEPC 2.25%), Kinder Morgan (KMI 0.52%), and Chevron (CVX -0.30%) stand out to some Idiot.com contributors as a few of the finest choices. These vitality shares all pay rising dividends, which can allow traders to money in on the rising want for vitality.

A excessive yield and a shiny future

Reuben Gregg Brewer (Brookfield Renewable): For those who like dividends, you will love Brookfield Renewable. It is available in two totally different flavors: a restricted partnership with a 5.3% yield and a company share class with a 4.5% yield.

The 2 share lessons characterize the identical precise entity, with the yield distinction solely pushed by the recognition of that company construction. However what precisely do they characterize?

Brookfield Renewable is run by Brookfield Asset Administration and owns an actively managed portfolio of renewable energy property. That features hydroelectric, photo voltaic, wind, and batteries. Principally, it offers you publicity to the entire essential clear vitality classes. Its portfolio can be unfold throughout the globe, offering geographic diversification as effectively. It is sort of a one-stop store for clear vitality.

However the secret is that Brookfield Renewable is actively managed. It likes to purchase property on a budget, improve their worth by investing in them, after which promote them when they’re expensive. The proceeds are put again into new funding alternatives.

This isn’t a typical vitality funding, it’s extra like a clear vitality hedge fund. However clear vitality demand is rising quickly, so there’s an enormous progress runway for Brookfield Renewable.

It is value a deep dive for dividend traders who can assume exterior the standard vitality field. Notably, the payout has been elevated usually for years at a beautiful annualized clip of round 6% over that previous 20 years.

Stomping on the fuel

Matt DiLallo (Kinder Morgan): Pure fuel demand on this nation is on monitor to develop briskly into the subsequent decade. Analysts anticipate that by 2030, the demand will rise by 20 billion cubic toes per day (Bcf/d) from final 12 months’s stage of 108 Bcf/d.

Driving this demand are issues like pure fuel exports (LNG and Mexico) and rising energy and industrial demand. On prime of that, synthetic intelligence (AI) knowledge facilities might drive vital further demand as a result of their large vitality wants. The bottom case is that they’ll add 3 Bcf/d to six Bcf/d of incremental demand by 2030, with 10-plus Bcf/d of upside potential.

Few firms are in a greater place to capitalize on this chance than Kinder Morgan. The main pure fuel infrastructure firm already strikes 40% of the nation’s fuel manufacturing and controls 15% of its storage capability. It has began securing initiatives to develop its capability.

For instance, the corporate and its companion lately authorized the $3 billion South System Growth 4 mission, which can add 1.2 Bfc/d of fuel capability within the Southeast when it comes on line in 2028. In the meantime, Kinder Morgan lately authorized a 570 million cubic toes per day enlargement of its Gulf Coast Specific pipeline. The $455 million mission will enter service by the center of 2026.

The corporate has many extra initiatives underneath improvement. They assist drive its view that it could possibly develop its secure money flows on a constant and sustainable foundation for a few years to come back. That ought to give the corporate loads of energy to proceed growing its dividend. It has grown its payout, which at the moment yields almost 5%, for seven straight years.

With a sturdy alternative to develop and a high-yielding and steadily rising dividend, Kinder Morgan is a superb vitality inventory to purchase proper now. It has a excessive likelihood of manufacturing above-average whole returns within the coming years.

A prime dividend inventory within the oil patch

Neha Chamaria (Chevron): Chevron’s dividend monitor report is among the many finest within the vitality sector. Whereas a number of oil and fuel firms pay common dividends, Chevron has elevated its dividend for greater than 35 consecutive years, together with an 8% dividend increase introduced earlier this 12 months.

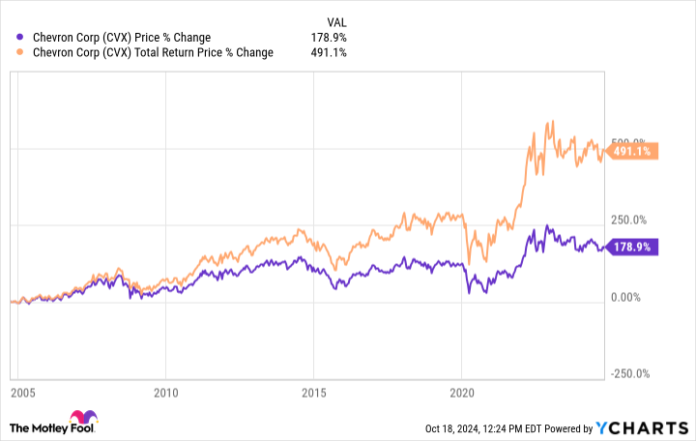

The corporate has additionally grown its dividend per share at a quicker compound annual price than friends like ExxonMobil previously 5 years. Over time, Chevron’s dividends, when reinvested, have contributed considerably to shareholder returns.

Shareholders can proceed to anticipate larger dividends from Chevron 12 months after 12 months, due to the corporate’s deal with rising its free money flows (FCF). So via 2027, administration expects its FCF to develop at a mean annual clip of greater than 10% at a Brent crude oil value of $60 per barrel.

Even higher, Chevron’s FCF might develop quicker if the oil large acquires Hess, which appears extra seemingly now that the deal has obtained the inexperienced mild from the Federal Commerce Fee. Chevron has already said that it expects its manufacturing and FCF to develop quicker and longer than its present five-year steerage after the acquisition.

That, after all, might additionally imply larger dividend raises for Chevron traders. Given FCF progress potential and a present yield of 4.3%, it seems to be like probably the greatest vitality dividend shares to purchase now.

Matt DiLallo has positions in Brookfield Asset Administration, Brookfield Renewable, Brookfield Renewable Companions, Chevron, and Kinder Morgan. Neha Chamaria has no place in any of the shares talked about. Reuben Gregg Brewer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Brookfield Asset Administration, Brookfield Renewable, Chevron, and Kinder Morgan. The Motley Idiot recommends Brookfield Renewable Companions. The Motley Idiot has a disclosure coverage.