Palantir inventory is buying and selling close to all-time highs.

Information analytics software program firm Palantir Applied sciences (PLTR -2.23%) has skilled plenty of ups and downs since going public in late 2020. Shortly after its IPO, Ark Make investments CEO Cathie Wooden continuously tuned into monetary information packages touting Palantir’s potential. Unsurprisingly, the inventory soared.

However this rise to the highest of the software program area was short-lived. The subsequent couple of years proved powerful for Palantir, as enterprise software program normally witnessed declining development on the backdrop of a troubled economic system. By the start of 2023, Palantir’s inventory worth was a mere $6.

Nonetheless, the expertise sector has witnessed a pointy bounce again over the past yr and a half resulting from rising curiosity in synthetic intelligence (AI). Palantir has been a beneficiary of AI tailwinds, and traders are rejuvenating the inventory. Since Jan. 1, 2023, shares of Palantir have rocketed by 575%.

Beneath, I will dig into Palantir’s $43 share worth and analyze if the inventory is just too costly proper now.

What’s fueling Palantir’s inventory worth?

Contemplating Palantir inventory has risen by such outsize magnitudes, it is pure to marvel what catalysts are fueling the inventory. Tying the inventory motion purely to demand for AI providers isn’t sufficient of a proof.

Listed here are 5 core concepts that I believe are pushing Palantir inventory to new highs.

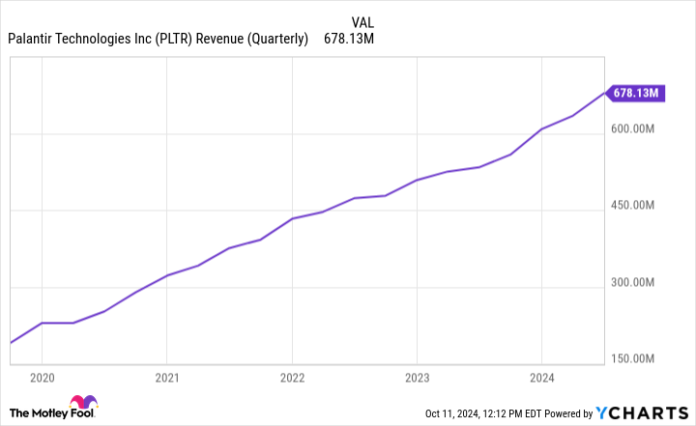

1. Income acceleration: The chart beneath illustrates Palantir’s quarterly income development since going public. Whereas the corporate’s high line has steadily risen, there are some notable time intervals to name out.

Between 2021 and 2023, Palantir’s income managed to extend however in an inconsistent vogue. Because the chart signifies, there are some noticeable intervals of extra protracted development that left some traders questioning Palantir’s potential.

PLTR Income (Quarterly) knowledge by YCharts

Nonetheless, in early 2023 the slope of the income line started to steepen fairly a bit. That is no coincidence. The corporate launched its fourth main software program suite, the Palantir Synthetic Intelligence Platform (AIP), in April 2023. Since its launch, Palantir’s development has began accelerating once more.

Whereas AIP has been a hit for Palantir to date, there’s extra to the image contributing to the corporate’s development.

2. Use instances: For a lot of its historical past, Palantir relied totally on authorities contracts — particularly with the U.S. navy and adjoining companies. The appearance of AIP has modified this dynamic dramatically.

To assist market the discharge of AIP, Palantir has hosted immersive seminars throughout which enterprise leaders can demo the corporate’s merchandise. The thought is for companies to establish a use case leveraging Palantir’s AI software program.

This strategy has been a giant hit to date. Over the past couple of years, Palantir has actually diversified its enterprise and is now rising considerably within the non-public sector.

Picture supply: Investor Relations.

3. Profitability: The mixture of top-line acceleration and a profitable penetration of economic enterprises has led to wider working margins and constant profitability for Palantir.

By reaching constant profitability, Palantir grew to become eligible for inclusion within the S&P 500. The corporate formally started buying and selling as a member of the S&P 500 in September, which I believe is a nod supporting the corporate’s long-term outlook. In different phrases, if Palantir’s development was solely due to the AI increase then it possible wouldn’t have acquired inclusion within the index.

4. Institutional shopping for: Turning into a member of the S&P 500 is a decent milestone. However I believe the actual tailwind of turning into a part of the index would be the potential for extra institutional traders to contemplate a place in Palantir.

5. Partnerships: The final concept I wish to cowl is Palantir’s relationship with large tech. Earlier this yr, the corporate signed strategic partnerships with AI bigwigs Microsoft and Oracle. Furthermore, the corporate continues to be a core participant within the public sector — a very profitable alternative as AI turns into a extra integral part of protection tech.

Picture supply: Getty Photographs.

What does the valuation recommend?

Whereas the entire elements above recommend Palantir has a brilliant future, it is crucial that traders take a tough have a look at the valuation fundamentals.

Proper now, Palantir trades at a price-to-earnings (P/E) a number of of 256. Candidly, that is so excessive that it is probably not an acceptable measure. The larger concept right here is that regardless that Palantir is lastly worthwhile, the corporate’s web earnings remains to be fairly small.

Though Palantir has a number of catalysts that would assist develop its income, I believe it is honest to say that the P/E ratio is disconnected from the present fundamentals of the enterprise. Moreover, even on a price-to-sales (P/S) foundation Palantir’s valuation growth can’t be denied when in comparison with different AI software-as-a-service (SaaS) friends.

PLTR PS Ratio knowledge by YCharts

Is Palantir inventory too costly?

My sincere opinion concerning Palantir is that the inventory is a bit overbought in the intervening time. Whereas I’m a bull and at present personal the inventory myself, traders should be cautious shopping for into alternatives with outsize momentum.

Quite a bit would wish to go unsuitable for Palantir inventory to return to $6. However with that stated, may a 20% sell-off occur? You wager.

On the finish of the day, shopping for shares now or ready for a extra cheap valuation is only your choice. Above all else, remember that making an attempt to time the right second to purchase a inventory is impractical.

As a substitute, you have to be excited about the long-term secular tailwinds fueling particular market themes and do your greatest to establish which firms will emerge as winners. To me, Palantir matches these standards when it comes to AI.

It is essential to keep in mind that development shares carry outsize volatility, and no firm is resistant to macroeconomic forces. Though I nonetheless imagine in Palantir, I believe shopping for at this worth requires the data that you simply’re investing at a premium valuation. Whereas that is not a foul factor per se, traders should be pondering long run with this chance.