Need to replicate the large progress of Tesla? This inventory is your ticket.

Everybody needs to search out the subsequent Tesla (NASDAQ: TSLA). However investing within the electrical car (EV) house may be tough. Many EV corporations have gone bankrupt over time, and separating the great from the dangerous may be tough.

Fortunately, Tesla established a transparent template for fulfillment. And proper now, there’s one EV inventory that appears extraordinarily engaging. However there’s just one funding technique more likely to succeed.

That is how Tesla grew to become a large success

In 2006, Tesla CEO Elon Musk revealed “The Secret Tesla Motors Grasp Plan” to the general public. “As , the preliminary product of Tesla Motors is a high-performance electrical sports activities automotive referred to as the Tesla Roadster,” his essay started. “Nevertheless, some readers will not be conscious of the truth that our long run plan is to construct a variety of fashions, together with affordably priced household vehicles.”

Musk summarized the grasp plan for Tesla:

- Construct a sports activities automotive

- Use that cash to construct an reasonably priced automotive

- Use that cash to construct an much more reasonably priced automotive

Right now, Tesla is a large image of success in relation to executing on long-term visions. The Tesla Roadster was a hit, however given its $100,000-plus worth level, its market was at all times small.

Tesla wanted to show its manufacturing chops, and present the general public that EVs might be cool and thrilling. It used this success to design, construct, and ship two new fashions: The Mannequin S and Mannequin X. These fashions had been nonetheless costly, however launched Tesla to a whole bunch of 1000’s of latest homeowners.

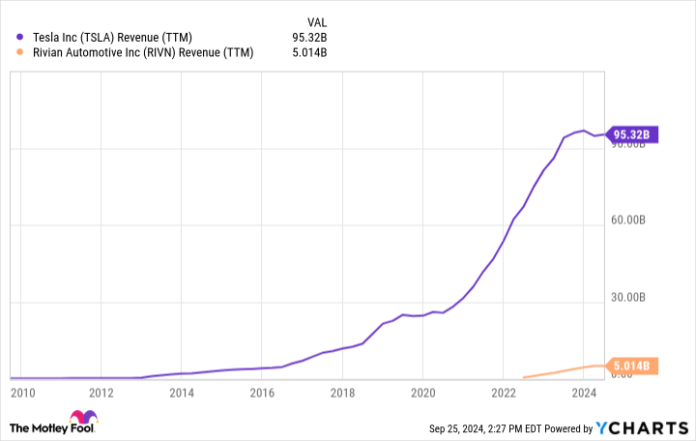

Tesla then used its repute and entry to capital to debut two new mass market fashions, the Mannequin 3 and Mannequin Y. These two fashions, with rather more reasonably priced worth factors, allowed Tesla to develop its income by greater than 1,000% during the last decade.

TSLA Income (TTM) information by YCharts.

Tesla’s grasp plan labored wonders for its valuation. The corporate is at present price round $800 billion. One other firm, in the meantime, is valued at simply $11 billion — but it is executing Tesla’s confirmed grasp plan flawlessly.

Rivian might be the subsequent huge EV inventory

In the case of following Tesla’s template for fulfillment, few EV corporations look as engaging as Rivian (RIVN 3.85%).

In 2018, Rivian introduced the debut of its R1T and R1S fashions. Like Tesla’s earlier fashions, the R1T and R1S had been ultra-luxury, high-quality, no-compromise autos with worth factors that might simply surpass $100,000 with sure choices. Client suggestions was improbable. Client Stories discovered that Rivian has the very best buyer satisifcation and loyalty ranges of any auto producer — electrical or in any other case. Round 86% of Rivian homeowners mentioned they might purchase one other Rivian. No different model was above the 80% mark.

What is going to Rivian do with its newfound repute and gross sales base? Precisely what Tesla did: Construct extra reasonably priced vehicles. Earlier this 12 months, the corporate revealed three new fashions: The R2, R3, and R3X. All are anticipated to debut with beginning costs beneath $50,000. It was assembly this worth level that helped put Tesla on the map for hundreds of thousands of individuals. If Rivian can execute, it ought to show very profitable.

If Rivian can replicate Tesla’s success, why is its market cap hovering simply above $10 billion? First, its new fashions aren’t anticipated to hit the highway till 2026 on the earliest. Second, the required manufacturing services aren’t even full but. Third, the corporate remains to be shedding cash at a fast clip since car manufacturing is capital intensive. Nevertheless, administration expects to achieve optimistic gross income by the tip of 2024. Lastly, Rivian is making an attempt to compete in a market section — electrical autos — that has seen many bankruptcies over time.

It is clear that the market is skeptical of Rivian’s plans, regardless that it’s executing on a confirmed mannequin for progress, and has demonstrated its potential to fabricate autos that clients love. The subsequent few years, nonetheless, might be pivotal. Rivian will grow to be a family identify like Tesla if it will possibly execute, a outcome that can doubtless see a fast growth in its valuation.

There isn’t any assure that the corporate will retain its potential to faucet capital markets affordably or get its manufacturing capabilities up and operating shortly. It should market its autos in a hypercompetitive trade. But it’s this uncertainty that gives affected person traders with a profitable entry level for Rivian inventory proper now. When you can stay affected person, Rivian’s rise might ultimately mirror Tesla’s.