Suppose Coca-Cola’s inventory has peaked? Let’s have a look at whether or not the enterprise and inventory have any room for additional development.

Beverage titan Coca-Cola (KO -1.47%) is on a roll. The inventory is buying and selling close to all-time highs after gaining 22% in 2024.

The steep value features made many buyers cease and rethink Coke’s inventory. Is there any room for additional development at this level, or is it simply too late to put money into Coca-Cola inventory right now?

I see many causes to get into Coca-Cola’s inventory right now. The energetic development catalysts embody advertising and distribution campaigns based mostly on synthetic intelligence (AI) analytics, the reformulation and relaunch of many standard drink manufacturers in particular markets around the globe, and revolutionary partnerships with different household-name manufacturers.

Coca-Cola’s advertising efforts are additionally fairly efficient. Trailing twelve-month gross sales are up 12.5% during the last two years, and the corporate is reaching this development whereas sustaining market-leading revenue margins.

Coke’s recipe for achievement: Unbeatable revenue margins

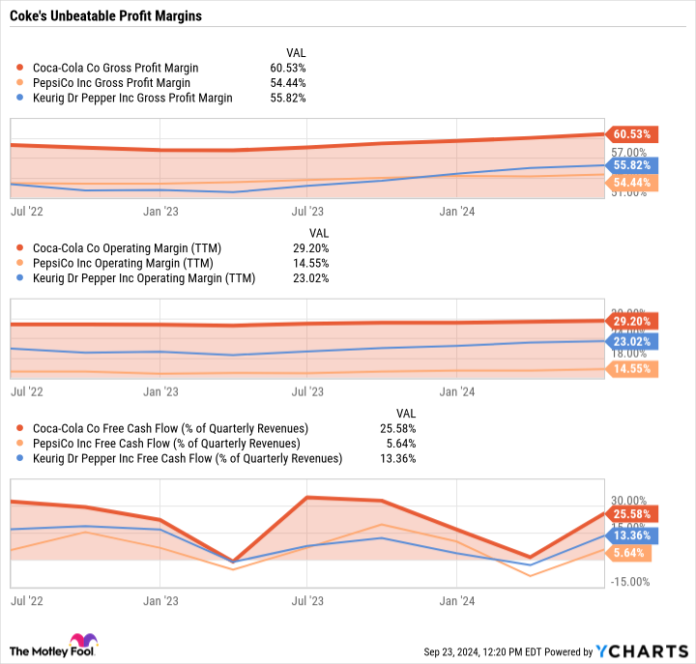

That is the purpose right here. Whether or not you are taking a look at elementary gross margins or efficiency-based working margins, Coca-Cola leaves chief rivals PepsiCo (PEP -0.91%) and Keurig Dr Pepper (KDP -0.66%) far behind. Coke additionally doubles the free-cash-flow margins of the runner-up, Keurig Dr. Pepper:

KO Gross Revenue Margin knowledge by YCharts. TTM = trailing 12 months.

As you possibly can see within the charts above, Coke’s rivals are consuming mud. Keurig Dr. Pepper is gaining some floor however has an extended method to go. Pepsi’s extra capital-intensive enterprise mannequin wasn’t designed for high-margin operations.

Coke’s unchallenged revenue margins show the corporate has a high-quality marketing strategy with sturdy pricing energy and a top-notch administration group. The highest-line development and industry-leading margins ought to keep intact for years to return, boosted by an open-minded method to new concepts resembling AI instruments and new taste recipes.

So, Coca-Cola’s inventory sells at a gentle premium to Pepsi or Keurig Dr. Pepper, however for all the correct causes. You must pay a bit extra for a real market chief. When you purchase some Coke inventory right now, it is best to be capable to maintain it for many years with good outcomes.

Anders Bylund has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.