These funds can assist you defend and develop your wealth.

You do not have to be a rocket scientist to earn a living within the inventory market. There are clever strikes on a regular basis traders could make to grow to be wealthier.

When you have $1,000 or in order that you do not want for dwelling bills or to pay down debt, and also you wish to make investments, listed below are two exchange-traded funds (ETFs) which are notably sensible buys at the moment.

A core index fund with a intelligent strategy to inventory weightings

Massive-cap shares function glorious foundational investments for a lot of traders’ portfolios. An index fund that tracks the S&P 500, which is comprised of 500 of the biggest and finest companies in America, could be an effective way to achieve publicity to this wealth-building asset class.

The Invesco S&P 500 Equal Weight ETF (RSP 0.96%) goes one step additional. Not like most S&P 500 index funds, that are weighted by market capitalization, Invesco’s ETF, as its identify suggests, weights the shares that it buys equally.

For traders who wish to personal large-cap shares however are involved that megacap shares like Nvidia, Apple, and Microsoft have grown too huge and account for too giant a portion of many index funds, the Invesco S&P 500 Equal Weight ETF could possibly be a wonderful selection.

By equally weighting its holdings, Invesco’s fund reduces focus danger. On this method, the ETF gives a higher degree of diversification for its shareholders, which it maintains by rebalancing its holdings quarterly.

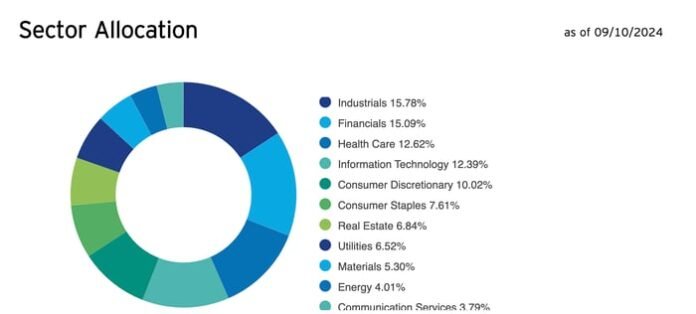

As an alternative of being overloaded with tech shares like many large-cap index funds, the result’s that Invesco’s ETF holdings are extra broadly allotted throughout sectors. Info know-how was truly its fourth-largest sector as of Sep. 10, behind industrials, financials, and healthcare.

Picture supply: Invesco.

Lastly, Invesco’s charges are cheap. The Invesco S&P 500 Equal Weight ETF has an expense ratio of 0.20%. That quantities to simply $2 per $1,000 invested per yr.

Smaller corporations, greater potential rewards

If you would like so as to add much more progress potential and diversification to your funding portfolio, check out the Vanguard Russell 2000 ETF (VTWO 2.48%). Vanguard’s ETF affords you a low-cost option to put money into a broad assortment of small-cap and mid-cap shares. These smaller companies are likely to have huge enlargement potential.

The Vanguard Russell 2000 ETF holds stakes in over 2,000 shares with a median-market worth of $3 billion. That is fairly completely different from the median-market cap of the shares held by the Invesco S&P 500 Equal Weight ETF, which stood at practically $100 billion as of June 30. The 2 funds are thus complementary. Collectively, they’ll add each ballast and high-powered progress to your portfolio.

Notably, small companies are typically extremely delicate to rates of interest. Within the present financial setting, that could possibly be an excellent factor. With inflation slowing, the Federal Reserve has indicated that it would begin slicing charges as quickly as this month. That could possibly be a boon for homeowners of small-cap shares. Small companies typically depend on loans to scale their operations, so they have an inclination to grow to be extra worthwhile when rates of interest fall.

With its annual expense ratio of simply 0.1%, the Vanguard Russell 2000 ETF may give you a easy, low-cost option to revenue from a rate-cut-fueled rally in small-cap inventory costs.

Joe Tenebruso has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.