This firm checks plenty of bins for the famend investor.

Few buyers in historical past have been as profitable as Warren Buffett. So when his firm Berkshire Hathaway (BRK.A -0.99%) (BRK.B -1.18%) provides a brand new inventory to its fairness portfolio, everybody needs to know why.

Berkshire Hathaway’s portfolio of shares is valued at over $300 billion, in keeping with CNBC. And within the second quarter, the conglomerate purchased shares of Ulta Magnificence (ULTA 1.05%) for the primary time. By June 30, it held over 690,000 shares of the cosmetics retailer, a place value about $250 million as of this writing.

Berkshire hasn’t defined why it invested in Ulta, however having adopted Buffett through the years, I’ve some concepts on why he is shopping for up shares of this firm.

Lipstick and KISS go collectively

I respect how Warren Buffett retains investing surprisingly easy (KISS). Realizing the corporate is vital right here, and as Buffett says, “By no means spend money on a enterprise you can’t perceive.”

Ulta Magnificence is a brick-and-mortar retail chain with greater than 1,400 places. Buffett may not perceive the ins and outs of each magnificence pattern or model identify in cosmetics, however he does perceive retail chains. Berkshire owns eating places, furnishings shops, fuel stations, and sweet shops. These aren’t in the cosmetics area, however many ideas from the retail enterprise mannequin apply.

In different phrases, Ulta Magnificence is straightforward sufficient to grasp as a enterprise. Furthermore, it is not a fast-changing business, which provides to the simplicity. Make-up was used in the course of the historic dynasties of China and Egypt in addition to by girls in the course of the Roman Empire. Demand for cosmetics is right here to remain.

Considered one of my favourite Buffett anecdotes was a dialog between him and his billionaire pal Invoice Gates, who was making an attempt to persuade him of the worth of non-public computer systems by saying, “It’ll change all the pieces.” In reply, Buffett wryly requested, “Will it change whether or not individuals chew gum?”

Buffett usually sees the worth in issues that do not change. And the cosmetics business offers Ulta a big, long-term alternative.

Present me the cash

Buffett usually talks a few difficult (however essential) investing idea referred to as intrinsic worth. He says, “Intrinsic worth may be outlined merely: It’s the discounted worth of the money that may be taken out of a enterprise throughout its remaining life.” There’s an excessive amount of there to completely unpack right here, however discover he’s centered on the money {that a} enterprise produces.

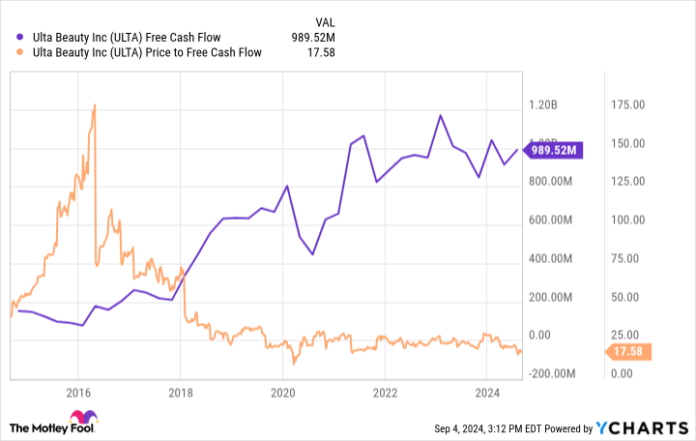

For Ulta Magnificence, its free money movement has steadily grown over the previous decade, and it now generates near $1 billion yearly. And from a valuation perspective, it trades at one in every of its most cost-effective ranges ever at lower than 18 instances its free money movement.

Information by YCharts.

I will not construct a mannequin right here to foretell Ulta’s intrinsic worth, however Buffett usually seems for companies the place he can predict the long-term money flows of the enterprise and purchase them at enticing valuations.

Give me the cash

Some companies require fixed funding to stimulate gross sales. In different phrases, shareholders see little or no money as a result of it is all plowed again into the enterprise to maintain it rising.

Different firms needn’t make investments a lot again into the enterprise, and Ulta Magnificence is a kind of firms. Because of this, a lot of its money may be returned to shareholders.

Certainly, returning money to shareholders is what it has been doing. During the last 10 years, Ulta Magnificence has repurchased shares, decreasing its excellent share rely and boosting its free money movement per share, because the chart under reveals.

Information by YCharts.

Most of the shares in Berkshire Hathaway’s portfolio have charts that appear like this, and it is one other doable cause Buffett is shopping for Ulta Magnificence inventory.

Placing all of it collectively, Ulta’s enterprise is straightforward to grasp and resistant to vary. This makes it simpler to foretell its future money flows — money flows it is utilizing to return capital to shareholders. Furthermore, it trades at an affordable valuation. This mixture of enticing qualities seemingly drove Buffett’s determination to spend money on Ulta Magnificence.

Jon Quast has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Berkshire Hathaway and Ulta Magnificence. The Motley Idiot has a disclosure coverage.