Though these corporations’ upside is probably not as excessive as Nvidia’s, they might current a much less tense path for traders.

There is not a inventory available on the market that has been talked about extra previously two years than Nvidia (NVDA -4.08%). The rise of synthetic intelligence (AI) has made Nvidia’s graphics processing items (GPUs) one of the crucial sought-after merchandise due to their position in coaching AI.

It has additionally made Nvidia one of many hottest shares available on the market. From September 2022 to the beginning of September 2024, its inventory rose over 750% — 18 occasions greater than the S&P 500‘s features over that span. That is not a straightforward feat for a corporation whose market cap was round $300 million on the time.

Nvidia has additionally posted monetary outcomes to again this hype, rising income and working revenue by 122% and 174%, respectively. The reward is properly deserved. That mentioned, there are two corporations that I would be extra more likely to put money into at this level as a result of there appears to be extra long-term certainty round their companies.

1. Taiwan Semiconductor

Taiwan Semiconductor Manufacturing Firm (TSM -4.20%) (TSMC) is likely one of the world’s most-important tech corporations regardless of not being a family identify like another huge tech corporations. It operates the world’s largest semiconductor (chip) foundry, manufacturing chips for corporations’ particular wants.

Firms come to TSMC with a chip design, and it produces the chip in line with the corporate’s request. It could appear easy sufficient, however manufacturing chips with that stage of precision and at that scale requires complicated processes (placing it frivolously) and superior know-how that no different firm has been in a position to match.

One firm that depends closely on TSMC is Nvidia. TSMC manufactures Nvidia’s chips for its GPUs, data-center processors, and different AI-related chips. With out TSMC’s manufacturing capabilities, there is a sturdy case that Nvidia’s merchandise would take a top quality hit. That is largely why Nvidia hasn’t embraced different chip producers and is snug counting on TSMC.

Nvidia’s dependence on TSMC is why I want it at this stage. A lot of Nvidia’s excessive valuation is constructed on expectations of what it ought to turn into, and its means to ship on that may rely upon TSMC’s manufacturing capability. The ceiling is probably not almost as excessive for TSMC, however its trajectory is seemingly extra dependable.

TSMC additionally has a horny dividend that reduces a few of the investing danger. Its dividend yield is presently above the S&P 500’s common, making it simpler for traders to stay affected person throughout rocky occasions and belief its long-term potential.

2. Apple

Apple (AAPL -0.70%) did not attain the purpose of being the world’s most beneficial public firm by mistake; it has taken a long time of non-complacency and disciplined execution. With Apple’s observe document of self-discipline, it was puzzling why so many Wall Avenue traders have been seemingly shocked as Apple remained comparatively quiet throughout latest AI mania.

Apple has a historical past of letting different corporations create one thing after which venturing into that space with a significantly better design and making it extra consumer pleasant. We have seen it with smartphones (iPhone), tablets (iPad), smartwatches (Apple Watch), digital actuality (Apple Imaginative and prescient Professional), and handfuls of different tech {hardware}.

In fact, Apple is not simply going round copying others; quite, the tech big does an ideal job of letting others be the guinea pigs after which studying maybe from their missteps earlier than releasing its personal services to the market. That appears to be the identical strategy it is taking with AI, too.

Apple hasn’t rushed into AI like most different huge tech corporations. Actually, it does not even seek advice from its coming AI capabilities as “synthetic intelligence”; it is “Apple Intelligence.” (It is simply intelligent sufficient to work.) Nvidia is in a risky place; simply as quick because it rose, it will probably fall if it fails to fulfill expectations. Apple does not fairly have that very same danger, although it isn’t exempt from volatility.

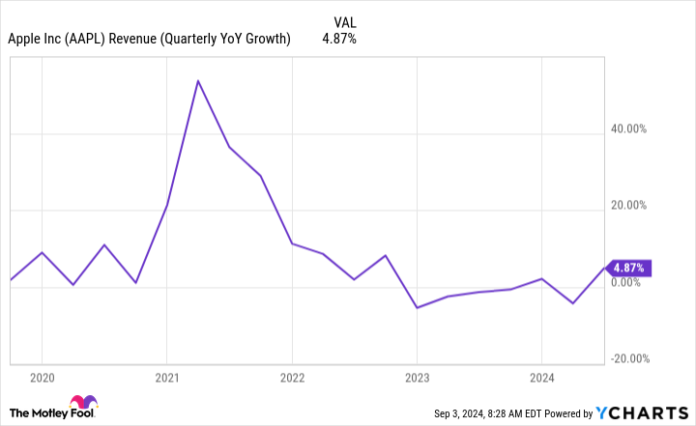

AAPL Income (Quarterly YoY Development) knowledge by YCharts.

Ideally, Apple Intelligence will give Apple an instantaneous monetary enhance, with shoppers dashing to purchase its next-gen merchandise since it will solely be accessible on newer {hardware} fashions. After a droop in Apple’s smartphone market over the previous few years, I am certain the corporate would not thoughts an additional raise from someplace.

Brief-term enhance apart, there aren’t too many corporations I belief extra long run than Apple. The upside at all times appears to outweigh the potential draw back.

Stefon Walters has positions in Apple. The Motley Idiot has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot has a disclosure coverage.