One analyst thinks gross sales of the corporate’s chipmaking machines are at a cyclical peak.

ASML Holding (ASML -3.14%) has been among the many semiconductor sector corporations having fun with rising gross sales due to the surge in synthetic intelligence (AI) spending. However its inventory has been on the decline, and shares dropped once more Wednesday morning.

ASML final reported quarterly earnings on July 17, and the inventory is down by practically 25% since then. That features a 3.9% decline as of 11:55 a.m. ET Wednesday. That newest drop got here after a Wall Road analyst who was beforehand bullish on the inventory publicly modified his stance.

ASML gross sales development faces headwinds

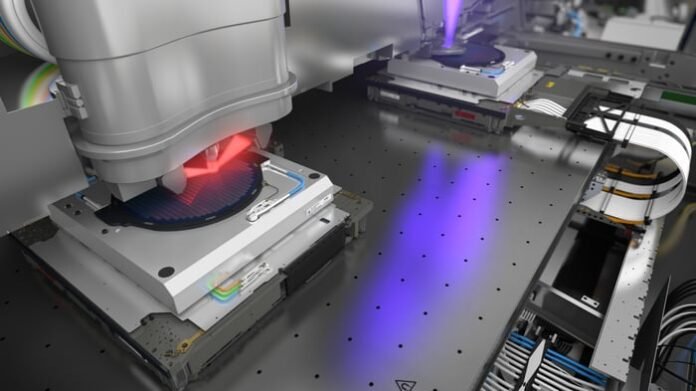

ASML provides the semiconductor sector with the lithography machines it must manufacture laptop chips — and it is the one maker of the acute ultraviolet (EUV) lithography machines mandatory to supply probably the most superior chips, that are flying off the cabinets because the demand for computing energy for AI coaching and different wants surges. During the last 12 months, ASML’s inventory worth rose as its income jumped by nearly 25% for the reason that begin of 2023 on a trailing-12-month foundation.

However in a brand new analysis notice, UBS analyst Francois-Xavier Bouvignies downgraded his suggestion for ASML from purchase to impartial (maintain), and wrote that he thinks shares will not transfer as excessive as he beforehand anticipated.

Whereas Bouvignies nonetheless sees some near-term potential upside from ASML’s robust order ebook, he believes that the present state of affairs could also be a short-term peak for the enterprise. The analyst believes the consensus outlooks for earnings over the subsequent one to 2 years are too excessive, and asserts that now shouldn’t be the time to be a purchaser of ASML’s inventory.

Picture supply: ASML Holding.

ASML’s lithography methods could also be important {hardware} for semiconductor makers which can be boosting output. However many purchasers could now have the manufacturing capability that they want, which might imply a coming drop in new orders. The way forward for the Chinese language market can also be an enormous query for ASML and others within the trade.

Bouvignies expects that Chinese language spending on chipmaking gear will drop meaningfully in each 2025 and 2026. Moreover, the Chinese language authorities has already threatened to chop off ASML in response to new U.S. and Dutch restrictions on tech exports to China.

Buyers are more likely to see extra volatility within the chip sector and for ASML shares particularly. However buyers can nonetheless usually ignore short-term noise relating to long-term holdings.

Howard Smith has no place in any of the shares talked about. The Motley Idiot has positions in and recommends ASML. The Motley Idiot has a disclosure coverage.