These cruise operators are nonetheless reeling from the pandemic, however hope could also be on the horizon.

Anytime a inventory is down because of circumstances largely outdoors of an organization’s management, like a worldwide pandemic, it is value analyzing whether or not it could possibly be a attainable bounce-back candidate. Cruise shares have been among the many hardest hit, with voyages coming to a standstill and corporations taking up vital debt to remain afloat.

Now that enterprise is again to regular, let’s examine in with two outstanding trade gamers, Carnival Company & plc (CCL -0.24%) and Norwegian Cruise Line (NCLH 0.22%), that are down roughly 60% from pre-pandemic highs, to see which inventory has the higher likelihood for a turnaround.

Cruise income is again, however earnings lag

Earlier than analyzing every firm’s income and internet revenue, it is value noting that Carnival is a a lot bigger cruise operator than Norwegian, with a market capitalization of $21.7 billion in comparison with Norwegian’s $7.9 billion.

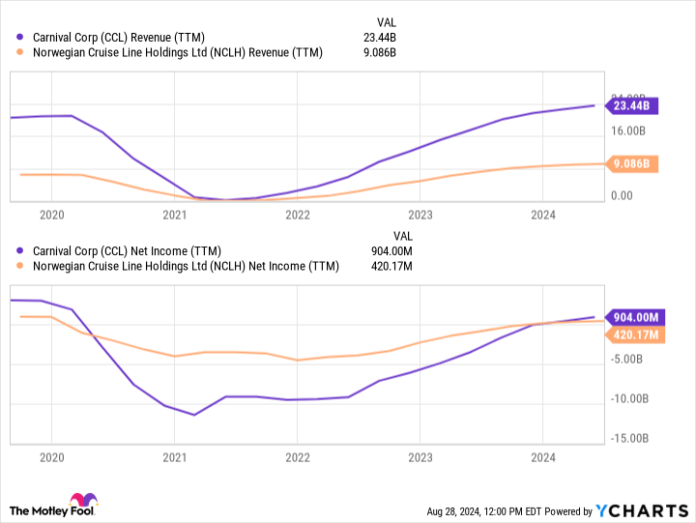

Over Carnival’s trailing 12 months, the corporate generated $23.4 billion in income, representing a 14% enhance from the identical interval 5 years prior. CEO Jeff Weinstein claims the renewed demand is not a fluke, stating on the corporate’s most up-to-date earnings name, “This isn’t pent-up demand, it’s the compounding impact of constructing elevated consideration in our cruise manufacturers over time and enchancment in our yield administration methods to translate that demand into increased ticket worth.”

Equally, Norwegian has set gross sales data over its trailing 12 months, with $9.1 billion, equating to a 43% enchancment from the identical 12-month interval 5 years prior. Norwegian CEO Harry Sommer echoed Weinstein’s sentiment on client demand in its newest earnings name, particularly noting that “sturdy demand” for cruises has led to report outcomes and record-breaking superior ticket gross sales.

As for the underside line, each corporations’ profitability has grow to be sustainable as soon as once more after bottoming out in 2021.

Over the trailing 12 months for every firm, Carnival produced $904 million in internet revenue in comparison with Norwegian’s $420 million. Given Carnival’s income is greater than double that of Norwegian, it is sensible that Carnival is extra worthwhile. Nevertheless, Norwegian has a greater working margin — the proportion of income an organization retains after accounting for the price of items offered and working bills — at 13.3% in comparison with Carnival’s 12.1%. Notably, each corporations’ working margins are nonetheless down greater than 25% in comparison with pre-pandemic ranges.

CCL Income (TTM) knowledge by YCharts

Getting out of the doldrums

The cruise trade naturally takes on debt due to the excessive value of ships, however the pandemic exacerbated that debt.

Earlier than 2020, Carnival had roughly $11 billion in internet debt, which steadily elevated till its peak of $30.5 billion on the finish of its fiscal yr 2022. The excellent news is that the corporate has been capable of pay down its debt — albeit slowly — to $27.7 billion as of its most up-to-date earnings report.

The dangerous information is that Carnival paid $1.4 billion in curiosity expense over the trailing 12 months, and its debt is not “funding grade,” which means any additional debt or refinancing might result in increased charges and servicing prices. Carnival’s administration is taking proactive measures to safe its stability sheet, like prepaying its increased rate of interest debt to scale back curiosity expense.

Comparatively, Norwegian’s money place adopted an identical trajectory, with $6.6 billion in internet debt previous to 2020, practically doubling to $12.8 billion as of Q2 2024. Norwegian’s internet debt is barely down 6% off its excessive in comparison with Carnival’s 9.3%, however the firm eradicated its highest-interest debt in March and obtained an improve on its debt scores. Equally to Carnival, Norwegian’s debt remains to be thought of non-investment grade. Over the trailing 12 months, Norweigan paid $775.2 million in curiosity expense, 63% decrease than its peak, whereas Carnival’s curiosity expense stays largely unchanged regardless of its internet debt enchancment.

CCL Web Whole Lengthy Time period Debt (Quarterly) knowledge by YCharts

Is Carnival Cruise Line or Norwegian Cruise Line the higher inventory to purchase?

These two corporations, dealing with related challenges, might want to proceed to prioritize debt to stabilize their stability sheet earlier than shares can attain pre-pandemic ranges. Whereas it could take time, every has proven promise for a attainable restoration because of report income and reaching profitability once more. However, in the event you have been to decide on only one inventory to purchase, it is necessary to think about valuation.

Utilizing the ahead price-to-earnings (P/E) metric, which compares a inventory worth to its anticipated earnings over the following 12 months, traders can evaluate every inventory’s valuation towards one another to find out which one gives a greater shopping for alternative.

Notably, Carnival and Norwegian not too long ago revised internet revenue forecasts upward, which means each administration groups anticipate a greater earnings outlook than earlier steering. Because of this, Carnival and Norwegian commerce at 14 and 11.6 instances ahead earnings, respectively. Not solely is Norwegian’s ahead P/E ratio cheaper than Carnival’s, nevertheless it’s additionally 42.2% decrease than a yr in the past. Comparatively, Carnival’s ahead P/E ratio is 9.1% increased than a yr in the past.

Whereas cruise operators is probably not a compelling selection for traders weary of debt ranges, the trade turnaround is in movement. Norwegian seems to be the higher selection for traders prepared to take an outsized danger, because it has a less expensive valuation and extra manageable debt than Carnival.