He can take his expertise from working different multinational restaurant chains to create worth for Starbucks shareholders.

Enormous information hit the restaurant area this month. Brian Niccol, the CEO who righted the ship at Chipotle, introduced a shocking job swap to change into the CEO of Starbucks (SBUX 1.72%). Starbucks made this transfer rapidly with the assistance of its board of administrators and ex-CEO Howard Schultz resulting from deteriorating monetary efficiency at Starbucks places across the globe.

Buyers applauded the transfer, sending Starbucks fill up over 20% within the days following the announcement. There are huge expectations for Niccol, a person who constructed the trendy Taco Bell and Chipotle manufacturers. However I believe buyers are underrating a possible growth that might unlock worth for Starbucks shareholders, a transfer that Niccol was part of when he labored at Yum Manufacturers (proprietor of Taco Bell).

This is my prediction for the large transfer Brian Niccol will make as soon as he will get settled in at Starbucks and why it could assist unlock worth for the inventory.

Brian Niccol: The restaurant model fixer

Who’s Brian Niccol? The long-standing government labored his approach up at Yum Manufacturers, ultimately changing into the CEO of Taco Bell in 2015. Throughout this time, he launched the “Reside Mas” advertising and marketing tag line and the Doritos Locos tacos, which have been large successes for Taco Bell. Typically, the division for Yum Manufacturers thrived below Niccol.

Across the identical interval, Chipotle went via an enormous tough patch after a number of salmonella outbreaks occurred at its restaurant places. Chipotle prides itself on having recent, never-frozen elements. This makes the meals style higher however introduces extra dangers for food-borne sickness. A salmonella outbreak is clearly unhealthy for a restaurant’s model, and site visitors at Chipotle places suffered consequently.

Then, in 2018, Chipotle made the transfer to rent Brian Niccol away from Taco Bell to change into Chipotle’s CEO. Since then, Chipotle has been considered one of, if not the best-performing, restaurant shares on the market. Identical-store gross sales development — which measures development at present eating places — has been persistently excessive, with sturdy site visitors and supply gross sales efficiency. Because the starting of 2018, Chipotle inventory is up 800%, outperforming the Nasdaq-100 index, which is “solely” up 200% over that very same time. The Nasdaq-100 Index tracks a number of the largest U.S. know-how corporations, corresponding to Nvidia, making it a excessive hurdle price for any inventory to beat. The very fact Chipotle is crushing this index is a testomony to how sturdy a supervisor Brian Niccol was for the model.

Studying from Yum Manufacturers and China

Starbucks buyers are hoping Brian Niccol can carry his playbook to Starbucks, which is presently battling same-store gross sales. In North America, same-store gross sales fell 2% yr over yr final quarter, pushed by a 6% decline in transactions. China seems to be even worse, with an unsightly comparable gross sales decline of 14%. These two markets are important for Starbucks as they make up over 61% of the corporate’s world shops.

China is meant to be a development marketplace for Starbucks. Nevertheless, resulting from authorities interventions within the financial system and hypercompetitive upstarts corresponding to Luckin Espresso, the phase is struggling mightily. The 7,306 shops within the nation are an enormous drag on the corporate proper now.

Because of this I believe Brian Niccol will spin out the Starbucks China enterprise as its personal separate firm. Yum Manufacturers did this with Yum China, incomes a small royalty for utilizing the corporate’s branding. This helped the Yum China subsidiary to develop a greater relationship with the Chinese language regulators and allowed administration to give attention to tailoring the enterprise particularly to the Chinese language market.

Starbucks may see the identical advantages from spinning out Starbucks China. This would not be uncommon for the corporate when working abroad. For instance, Starbucks already has the Mexican firm Alsea Group, which runs its places in Central and South America. This could possibly be a simple solution to repair the bleeding with the Chinese language subsidiary, which is why I believe Niccol will make the transfer inside just a few years.

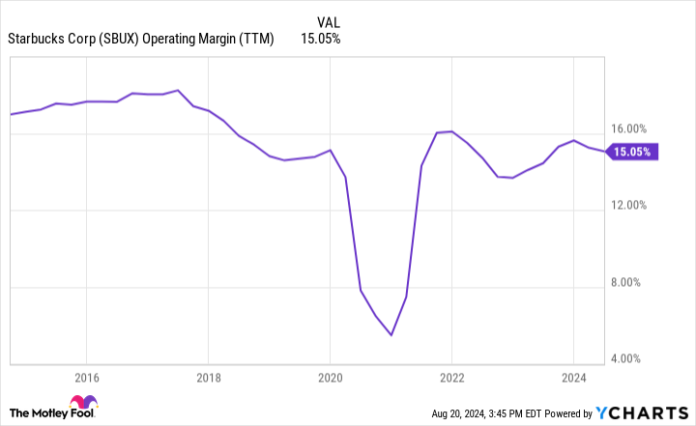

SBUX Working Margin (TTM) knowledge by YCharts

Is Starbucks inventory a purchase?

Whether or not this prediction comes true or not, Niccol and the Starbucks workforce nonetheless want to repair the North American enterprise. Prospects have complained about lengthy wait instances within the morning when ordering via the app and a robotized expertise when making a Starbucks run. That is far-off from the historic Starbucks expertise that welcomed folks for conferences, dates, and a 3rd place for work.

I have no idea what particular issues Starbucks will do to get the enterprise again on observe. However I haven’t got any expertise working a restaurant. Brian Niccol does. Given his observe document at Taco Bell and Chipotle, buyers ought to believe that he can enhance Starbucks’s financials.

In the present day, Starbucks has a price-to-earnings ratio (P/E) of 26.2. For a mature enterprise, this doesn’t look dust low cost. This may occasionally not seize the large image, and the truth that Starbucks is dealing with declining working margins, which have fallen to fifteen% vs. nearer to twenty% earlier than the pandemic. If revenue margins enhance (one thing Niccol did splendidly at Chipotle, by the way in which) and income begins rising once more, Starbucks may develop its earnings at a powerful price over the subsequent 5 years, making the P/E of 26 come down fairly rapidly vs. present costs.

Take every part collectively, and I believe now is an effective time to purchase Starbucks inventory for those who consider within the model and Brian Niccol’s experience in working eating places.

Brett Schafer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Chipotle Mexican Grill, Luckin Espresso, Nvidia, and Starbucks. The Motley Idiot recommends the next choices: brief September 2024 $52 places on Chipotle Mexican Grill. The Motley Idiot has a disclosure coverage.