Shake Shack could lastly be positioning itself for stronger share worth returns.

On Aug. 1, standard burger chain Shake Shack (SHAK -1.94%) reported monetary outcomes for its fiscal second quarter, exhibiting income development of 16%. That was nearly nearly as good because the 18% income development Chipotle Mexican Grill (CMG -2.78%) reported in its second quarter.

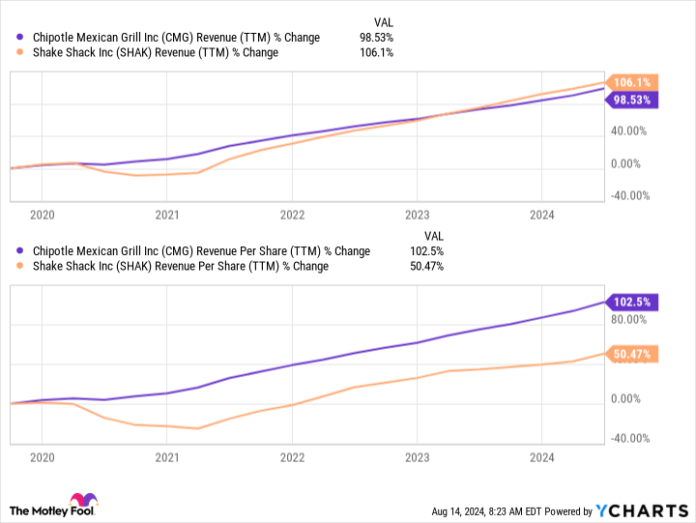

That is regular. The 2 chains have grown at an identical tempo over the past 5 years with Shake Shack barely outpacing Chipotle. However should you invested $1,000 in Chipotle inventory 5 years in the past, you’d have practically $3,200 now. Should you had finished the identical factor with Shake Shack inventory, you’d have simply $1,100 at present.

Income development is one of crucial issues to search for when investing in shares, nevertheless it’s removed from the one factor. And one chart exhibits why Shake Shack’s development hasn’t enriched its shareholders prefer it has for Chipotle buyers.

The one chart it’s important to see to consider

When firms initially go public, they promote shares to buyers to boost capital. However the share depend modifications thereafter. Corporations can concern new shares to boost extra money or pay workers, which will increase the variety of shares excellent. And these firms can even use earnings to repurchase shares from buyers, which reduces the variety of shares excellent.

For its half, Chipotle has modestly decreased its share depend over the past 5 years, whereas Shake Shack’s share depend elevated dramatically. Subsequently, whereas the latter’s income has greater than doubled, its income per share is barely up about 50%.

Information by YCharts.

There isn’t any approach to know for certain, but when Shake Shack’s share depend had held regular and even decreased over the past 5 years, I’d wager the inventory could be beating the S&P 500 over this time. In spite of everything, its development has been stellar. However the rising share depend has diluted shareholder worth, undoing a lot of the constructive impact from its prime line.

What concerning the subsequent 5 years?

The excellent news right here for Shake Shack shareholders is that issues could possibly be totally different over the following 5 years. The corporate presents stock-based compensation to managers to higher align them with the corporate. However a lot of what is occurred prior to now was associated to an incentive plan adopted in 2015, and issues are slowing down.

Final quarter, Shake Shack’s diluted-share depend really dropped on a year-over-year foundation. Granted, administration did not scale back the share depend with share repurchases. Somewhat, some potential compensation has been forfeited.

Nonetheless, this does recommend Shake Shack is beginning to flip the nook on this concern, which means its revenue-per-share development may quickly extra intently resemble its precise income development. That could possibly be an enormous deal.

As I discussed, income development is necessary for shares. Shake Shack has development in spades — it opened practically 80 new areas over the previous 12 months, a lot of that are owned by the corporate. Income may proceed to develop at a double-digit tempo for years.

Furthermore, Shake Shack is worthwhile, one other necessary think about how a inventory performs. The corporate had working earnings of practically $11 million in its fiscal Q2. And with ongoing funding in expertise to maintain labor bills in test, that quantity ought to climb greater.

To be clear, I am not personally prepared to offer Shake Shack the advantage of the doubt. Buyers can afford to be affected person for now, ready to see if latest tendencies proceed. However I am keen to observe the enterprise extra intently going ahead as a result of the corporate’s development could lastly be on the cusp of higher rewarding shareholders within the coming years.

Jon Quast has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Chipotle Mexican Grill. The Motley Idiot recommends the next choices: brief September 2024 $52 places on Chipotle Mexican Grill. The Motley Idiot has a disclosure coverage.