The Oracle of Omaha’s popularity for selecting winners stays intact. Be happy to comply with his lead.

Warren Buffett’s understanding of how the inventory market works remains to be second to none. That is the chief motive why — after a brief hiatus throughout and due to the COVID-19 pandemic — Berkshire Hathaway is as soon as once more outperforming the general market. You would be sensible to poach a number of of Buffett’s picks when you may.

To this finish, here is a better take a look at three of the highest Buffett picks to begin with sooner slightly than later.

Financial institution of America

Anybody maintaining tabs on Buffett or Financial institution of America (BAC -4.86%) of late most likely already is aware of that Berkshire’s been promoting off sizable chunks of its BofA holding. As of the newest look, he is offered roughly $3 billion value of the financial institution’s inventory simply since mid-July, abandoning practically 962 million shares value round $40 billion. Each figures could possibly be smaller by the point you are studying this although; we’ll know for positive on Saturday, Aug. 3, when Berkshire Hathaway is scheduled to report its second-quarter outcomes.

On the floor it is a pink flag. These gross sales superficially counsel Buffett and his group of managers are souring on Financial institution of America’s prospects. Possibly they’re involved in regards to the financial institution’s rising losses on loans, or its shrinking web curiosity revenue, fearing these metrics are an omen of what is to return.

The reasoning behind the sale, nevertheless, will not be practically as dire as some are speculating. In all chance, Berkshire is solely taking some earnings on what’s develop into an overvalued inventory.

Because of BofA’s 65% run-up from its October low, shares are actually priced about 20% above their e book worth. That is neither outrageous or unsustainable, to be clear, however provided that tax charges on capital positive factors might quickly be bouncing greater following their short-term discount, now’s arguably a greater time than later for Berkshire to tweak its portfolio.

Here is the factor: Buffett’s tax considerations might or will not be your tax considerations. You are additionally not as more likely to be as overloaded with financial institution shares as Berkshire at present is. Certainly, newcomers can be shopping for a stable financial institution inventory that is boasting a powerful forward-looking dividend yield of two.4%.

Chevron

Some traders are shocked to study that Chevron (CVX -2.67%) is not simply in Berkshire’s portfolio, however that it is the fund’s fifth-biggest place — a stake value practically $20 billion. Positive, the world’s nonetheless burning loads of oil and fuel. That is simply transitional although, now that alternate options like solar energy and electrical automobiles are coming into the mainstream. And crude oil’s value hasn’t actually budged since late 2022 regardless of rekindled financial power since then, underscoring arguments that the power business’s future is — at finest – questionable.

However rumors of the oil and fuel enterprise’s impending finish could also be drastically exaggerated. The USA Vitality Info Administration believes pure fuel will nonetheless be the nation’s single-biggest supply of electrical energy manufacturing past 2040, whereas Commonplace & Poor’s predicts (because of the continued use of combustion-powered vehicles) that liquid fuels will nonetheless be the planet’s most-used supply of gasoline for power creation as far down the highway as 2050. We’re additionally going to wish about as a lot petroleum and associated liquids then as we do now.

Join the dots: There are nonetheless a minimum of a number of a long time’ value of excellent cash to be made within the oil drilling, extraction, and refining enterprise.

Do not misunderstand. Chevron shouldn’t be and can by no means be a progress inventory. It is all in regards to the money circulate stemming from the extraction of crude oil and its conversion into gasoline. This dependable money circulate in flip helps Chevron inventory’s continued dividend funds. A little bit over half of the corporate’s earnings are handed alongside to shareholders within the type of dividends, actually. With newcomers stepping in whereas the dividend yield stands at slightly greater than 4%, nevertheless, it is a truthful trade-off. Buffett appears to suppose so anyway.

American Categorical

Final however not least, add American Categorical (AXP -6.59%) to your record of Warren Buffett shares to purchase hand over fist in August. You probably lump it along with rival bank card firms Visa and Mastercard, (each of that are additionally Berkshire holdings by the best way). And to be truthful, there are clear similarities. However there are essential variations, too.

Chief amongst these variations is the truth that the perks and rewards supplied to American Categorical cardholders are way more intensive than these out there to Mastercard and Visa cardholders. For example, American Categorical’ Platinum playing cards outright supply annual credit score towards lodge stays, credit with choose retailers, and ride-hailing credit. That is along with money again on a proportion of grocery purchases and factors for reserving flights with sure airways.

These perks aren’t at all times free, thoughts you. Though the corporate does supply no-fee playing cards, to obtain the easiest of its rewards packages, cardholders should pay anyplace from a number of hundred to a number of hundred {dollars} per yr. The factor is, these perks are value it, usually greater than paying for themselves.

Extra to the purpose for traders, American Categorical is not a lot a bank card firm as it’s a rewards-program administration outfit that simply occurs to make use of bank cards and cost playing cards as the idea for working its enterprise.

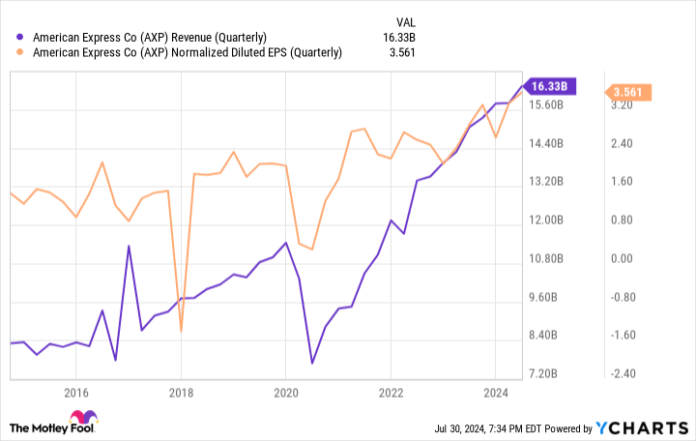

Extra essential than that, the mannequin works! Excluding pandemic-crimped 2020, this firm’s high line has grown yearly since 2017. Working revenue and per-share revenue progress has been nearly as impressively constant. That is arguably the large motive Buffett hasn’t simply caught with the inventory, however has allowed it to develop into Berkshire’s third-biggest holding now value over $38 billion.

AXP Income (Quarterly) information by YCharts

The kicker: Though American Categorical inventory has dramatically outperformed Visa and Mastercard shares because the market’s early 2020 low, at a trailing price-to-earnings ratio of lower than 19, this ticker remains to be cheaper than both of these competing names.

It is value including that this current outperformance probably displays American Categorical’ extra prosperous buyer base, which is not struggling fairly the identical financial hardship different bank card firms’ prospects are at the moment. So long as the present state of affairs stays the established order, this inventory might proceed to outperform different gamers in the identical enterprise.

Financial institution of America is an promoting companion of The Ascent, a Motley Idiot firm. American Categorical is an promoting companion of The Ascent, a Motley Idiot firm. James Brumley has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Financial institution of America, Berkshire Hathaway, Chevron, Mastercard, and Visa. The Motley Idiot recommends the next choices: lengthy January 2025 $370 calls on Mastercard and brief January 2025 $380 calls on Mastercard. The Motley Idiot has a disclosure coverage.