Nvidia’s enterprise has been firing on all cylinders.

Nvidia (NVDA -3.22%) has rapidly turn out to be probably the most useful shares on the planet. And even with its valuation north of $3 trillion, it nonetheless would not be shocking to see the unreal intelligence (AI) inventory rise even increased within the months and years forward. Nvidia’s success and the explanation it might proceed to soar increased might be summarized with three extremely spectacular visuals.

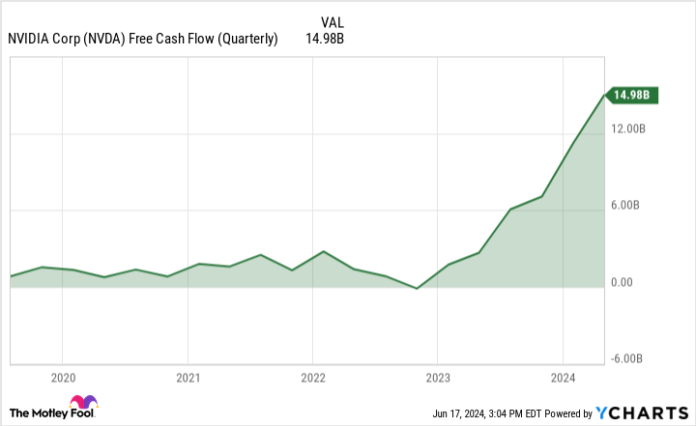

Nvidia’s money stream paves the best way for development alternatives

Free money stream is a vital metric for tech firms and any enterprise that is centered on development. It represents how a lot cash an organization is producing after factoring in its capital expenditures. This successfully tells buyers how a lot room there may be for the corporate to reinvest in its operations. This could embrace buying an organization or growing new merchandise.

NVDA Free Money Circulation (Quarterly) knowledge by YCharts

Nvidia’s free money stream has exploded in latest quarters. In earlier years, the corporate’s annual money stream would usually are available in at lower than $5 billion. Now, on a quarterly foundation, it is bringing in round $15 billion. It is an unbelievable amount of money, which opens up loads of alternatives for Nvidia, which might unlock much more development potential for this already fast-growing enterprise.

Its development price has taken off

It wasn’t all that way back the place Nvidia’s gross sales have been declining on a year-over-year foundation. Not solely is that not an issue, however the large query transferring ahead is how lengthy the corporate can proceed to triple its high line; its development price has been north of 200% for a number of quarters as enterprise has been booming.

NVDA Income (Quarterly YoY Development) knowledge by YCharts

There’s nonetheless loads of demand for AI chatbots, AI fashions, and all kinds of next-gen applied sciences that can require Nvidia’s chips and merchandise. Even when its development price does inevitably begin to decline, Nvidia’s spectacular current development price might make sure the inventory’s valuation stays elevated for the foreseeable future.

Nvidia has an unbelievably excessive revenue margin

It is one factor to be producing sturdy top-line development, however what’s much more spectacular is that Nvidia has been ready to do this whereas additionally growing its margins. At present, its revenue margin is north of fifty%. Which means that for each greenback of income it generates, greater than fifty cents are going straight to the underside line. With development like that, it would not matter that its earnings a number of is excessive at round 80 as a result of it might come down in a rush.

NVDA Revenue Margin (Quarterly) knowledge by YCharts

Is Nvidia inventory nonetheless a purchase?

Deciding whether or not to purchase Nvidia’s inventory generally is a difficult proposition. On the one hand, you’ve got an extremely profitable enterprise that’s producing incredible numbers and nonetheless has a whole lot of development potential. Nonetheless, you could fear that its valuation has turn out to be extreme and that there’s a bubble in AI that is certain to pop, and when that occurs, Nvidia’s valuation might tumble.

The worst I can see taking place is that buyers do pay a smaller premium for Nvidia’s inventory, and its shares might fall. However over the long run, with a lot potential in AI and for it to have an effect on so many industries, and Nvidia being a pacesetter in AI chips, it is arduous to not prefer it as a long-term maintain. Even when its development price slows down and its margins decline, it might nonetheless be a superb development inventory in any case of that. So long as you are keen to carry on for a number of years, then sure, Nvidia can nonetheless be a stable inventory to purchase proper now.

David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.