With all-important cash like Bitcoin, (BTC -0.71%) Solana, (SOL -6.07%) and XRP (XRP -2.64%) hovering close to their all-time highs, it is a good time to be a cryptocurrency investor. And, fairly quickly, just a few new developments ready within the wings that might make it a fully nice time.

Listed below are the catalysts that might usher in a brand new gold rush for these currencies, probably earlier than the tip of the yr.

1. The potential of a nationwide cryptocurrency reserve

By now, you’ve got in all probability heard that the brand new Trump administration has floated the thought of a strategic Bitcoin reserve (SBR). Whereas there isn’t any assure that such a factor will come to go, primarily based on the discussions with the presidential transition crew to this point, some buyers are anticipating official coverage updates throughout the first 100 days of the brand new administration.

That may make for a whopper of a strong catalyst for Bitcoin someday within the first quarter of this yr. There in all probability are no endorsements of the coin’s worth which are stronger than the U.S. authorities’s. If the SBR is created, it will likely be a significant affirmation of Bitcoin’s core funding thesis.

However the brand new administration won’t cease at making an SBR. Not too long ago, the thought of an SBR has been expanded into what may turn into a nationwide cryptocurrency repository. If applied, that idea would imply that the federal government may also purchase Solana, XRP, and maybe different main U.S.-based cryptocurrencies.

In brief, offering broad-based shopping for stress with the monetary heft of a authorities may ship these cash greater than what buyers could also be anticipating on a long-term foundation, and it may begin to occur very quickly.

2. The situations for a bubble are in place

Cryptocurrency markets are very delicate to borrowing prices.

When rates of interest rise, interesting yields on risk-free Treasury securities give buyers little cause to purchase extra speculative property like cryptocurrencies. In distinction, when cash is cheaper to borrow, buyers have to take greater dangers to get a stable return as a result of sitting on the most secure investments not supplies an advantageous yield.

In that vein, Bitcoin, Solana, and XRP are all property that stand to achieve as rates of interest fall. If the Federal Reserve continues its marketing campaign of rolling again rates of interest in 2025 prefer it did in 2024, it is pure to anticipate that more cash will movement into crypto.

Nevertheless it is not simply the Federal Reserve within the U.S. that is reducing borrowing prices. Many worldwide central banks, together with within the U.Okay., EU, and China, are both contemplating or have already minimize charges as effectively. And whereas it is not a certainty that buyers in these areas will instantly flock to those main cryptocurrencies, in the course of the subsequent few years a minimum of a few of them will in all probability present up with a few of their capital, which is bullish for all three.

3. The bear market blues are lifting

Throughout bear markets, it’s extremely regular for buyers to turn into pessimistic concerning the long-term potential of their holdings.

Then, tragically, this pessimism holds them again from from shopping for property exactly once they’re the most affordable, and when the potential monetary features are the best. That is known as the bear market blues, and whereas it is not rational, it’s a situation that may maintain down complete markets for a lot of quarters on finish.

Even when property begin to recuperate from a downturn, it may take a very good whereas earlier than folks acknowledge that the scenario is not as grim as earlier than. Usually it takes constantly sturdy progress to treatment the blues and restore optimistic sentiments.

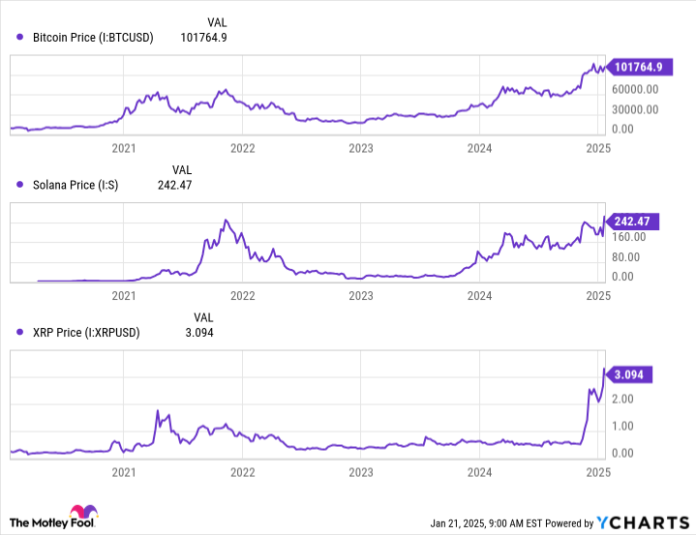

Now, have a look at these charts:

Bitcoin Worth information by YCharts

Discover something?

With Bitcoin, Solana, and XRP, buyers who bought their tokens in the course of the absolute heights of the speculative frenzy of 2021 and held them till now are sitting with some earnings. The cash are clearly displaying vigor as soon as once more. That is what’s wanted for curing the bear market blues.

The takeaway is that when buyers end shaking off their remaining hang-ups from the bear market, they are going to be prepared to purchase en masse as soon as once more, and it’ll very probably buoy main cryptocurrencies once they do.