For Kraft Heinz (KHC 0.20%) shareholders, 2024 was probably a yr to neglect. Weak progress and disappointing earnings from the packaged meals large pressured the inventory, down about 16% over the previous yr and deeply underperforming inventory market benchmarks just like the S&P 500 index.

However, the sort of volatility can generally current buyers with a compelling alternative to choose up shares of an business chief at a pretty worth. The beginning of a brand new yr brings renewed optimism for improved operational efficiency, which may set the stage for shares to rebound sharply.

Listed here are three causes to purchase Kraft Heinz inventory now.

1. An bettering outlook into 2025

Kraft Heinz is acknowledged for its in depth portfolio of iconic meals and beverage manufacturers, together with Kraft, Heinz, Philadelphia, Ore-Ida, Maxwell Home, and Jell-O, amongst many others. The corporate’s fame for prime quality has gained a loyal client following worldwide as each family pantry staples and important components within the meals service business.

That being mentioned, the final couple of years have been traditionally difficult for Kraft Heinz, which is trying to navigate a shifting macroeconomic panorama and coping with the rise of extra budget-conscious shoppers pushing again in opposition to larger pricing. That theme was evident within the firm’s final reported third quarter (for the interval ended Oct. 30), when natural web gross sales decreased by 2.2% yr over yr, reflecting decrease gross sales volumes in key segments.

The excellent news is that regardless of its top-line weak spot, the corporate is discovering some success in producing monetary efficiencies in help of profitability margins. Third-quarter adjusted earnings per share (EPS) favorably climbed by 4.2%, highlighting an general sense of basic stability.

Notably, legendary investor Warren Buffett, by means of Berkshire Hathaway, stays Kraft Heinz’s largest shareholder, holding 326 million shares, or practically 27% of the whole firm, suggesting continued confidence in its long-term outlook.

The brand new yr could possibly be the beginning of that turnaround story. In line with Wall Road estimates, Kraft Heinz is anticipated to get again on monitor with extra constant worthwhile progress within the low-single-digit vary.

The bullish case is that there’s some upside to the present estimates as client spending demand, notably within the core North American market, advantages from a resilient economic system and even current rate of interest cuts by the Federal Reserve. Proof over the following few quarters that Kraft Heinz has left the worst of its working developments up to now could possibly be the spark the inventory must maintain a rebound larger.

| Metric | 2024 Estimate | 2025 Estimate |

|---|---|---|

| Income (in billions) | $26.0 | $26.1 |

| Income progress (YOY) | (2.5%) | 0.3% |

| Adjusted earnings per share (EPS) | $3.01 | $3.07 |

| Adjusted EPS progress (YOY) | 1% | 2% |

Knowledge supply: Yahoo Finance. YOY = yr over yr.

2. A improbable high-yield dividend

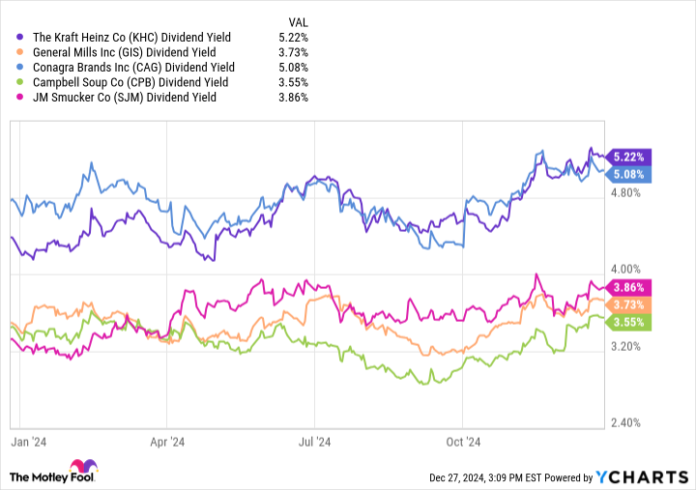

Perhaps one of the best motive to purchase shares of Kraft Heinz is its improbable 5.3% dividend yield. That degree is properly above its business group common, nearer to 4%, from packaged meals friends like Conagra Manufacturers and JM Smucker.

Regardless of the underwhelming earnings developments, Kraft Heinz continues to ship vital free money stream that greater than covers the present $0.40 per share quarterly payout, which is an encouraging signal that the distribution is sustainable for the foreseeable future. Feedback from administration have reaffirmed its dedication to return money to shareholders, together with ongoing inventory buybacks.

Whether or not or not the share worth rallies larger immediately, shareholders are getting paid to attend, and that is all the time factor.

KHC Dividend Yield information by YCharts

3. KHC’s dirt-cheap valuation

The opposite metric that stands out when Kraft Heinz is the corporate’s price-to-earnings (P/E) ratio, buying and selling at simply 10 occasions the 2024 consensus EPS of $3.03. This earnings a number of marks a deep low cost in comparison with the sector and its packaged meals friends like Basic Mills and Campbell Soup, which commerce above 13 occasions ahead earnings.

For buyers assured in a turnaround from Kraft Heinz, there is a case to be made that shares are merely undervalued and might command a wider premium because it will get again on monitor.

KHC PE Ratio (Ahead) information by YCharts

My remaining ideas

Kraft Heinz nonetheless has loads to show in what might be a essential 2025. Balancing the uncertainties, I consider there’s room to show bullish on the inventory, with the present worth close to a 52-week low as a superb shopping for alternative. The inventory with its high-income part could make a fantastic addition to a diversified portfolio.

Dan Victor has no place in any of the shares talked about. The Motley Idiot has positions in and recommends J.M. Smucker. The Motley Idiot recommends Campbell’s and Kraft Heinz. The Motley Idiot has a disclosure coverage.