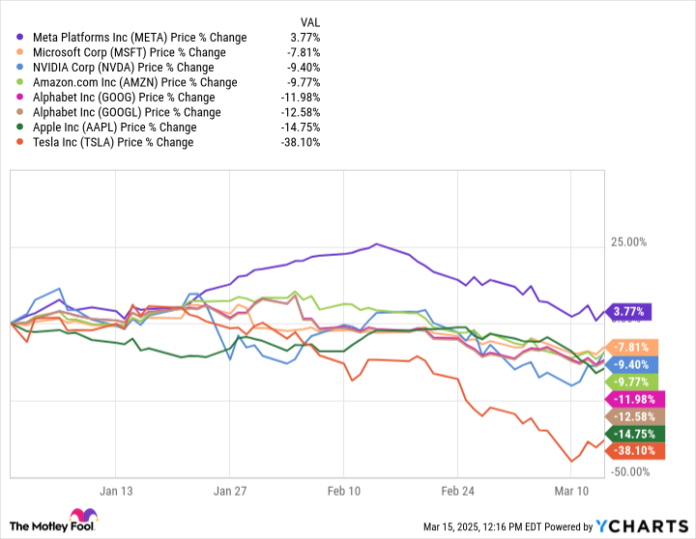

It is honest to say the broad market and “Magnificent Seven” shares have seen higher days. The Nasdaq Composite just lately entered correction territory, and the index is down 8.1% yr thus far.

Among the many Magnificent Seven shares — Apple, Nvidia, Microsoft, Amazon, Meta, Tesla, and Alphabet (GOOG 1.75%) (GOOGL 1.68%) — solely Meta remains to be within the inexperienced thus far this yr.

Information by YCharts.

Nonetheless, it is not time to sound the alarm simply but. If something, now could be the time to consider cut price buying.

One beaten-down Magnificent Seven inventory that is trying more and more interesting is Alphabet. It is down about 20% from February’s all-time excessive, however its enterprise has a ton of momentum behind it. Should you’re attempting to find bargains on this sell-off, listed here are three causes to contemplate Alphabet.

1. Alphabet continues to be a money cow

Alphabet has a formidable portfolio of corporations: Google, YouTube, Waymo, DeepMind, and Calico, amongst others.

Whereas a few of these companies fall into Alphabet’s “Different Bets” phase as a result of they’re extra experimental and targeted on long-term innovation, corporations like Google and YouTube have turned Alphabet right into a premier money cow.

In 2024, Alphabet generated over $350 billion in income, up 14% and nearly $100 billion greater than what it reported three years in the past. Solely 10 different public corporations have generated extra income of their previous 4 quarters.

Alphabet’s spectacular income and working revenue (over $112 billion in 2024) clarify how the corporate has managed to build up $96 billion in money, money equivalents, and short-term marketable securities.

Having a big money reserve offers Alphabet loads of flexibility to make the suitable investments for development, placing it ready to climate most financial storms that come its means. That is key to long-term stability.

2. Google Cloud might be Alphabet’s subsequent main money-maker

Google Cloud is Alphabet’s fastest-growing phase. Within the fourth quarter, its income elevated 30% yr over yr to $12 billion, or 12.4% of complete income. In the identical quarter two years in the past, its share of the highest line was 9.6%. And 5 years in the past, it was simply 5.7%.

It has a methods to go to catch as much as Amazon Internet Providers (AWS) and Microsoft Azure by way of market share, nevertheless it’s very a lot trending in the appropriate path. As of This fall, AWS and Azure had a 30% and 21% market share, respectively, whereas Google Cloud sat at 12%.

With the cloud computing market projected to have a compound annual development price (CAGR) of greater than 16% via 2032, Google Cloud would not have to overtake AWS or Azure to be a profitable enterprise. Its present trajectory means it would declare extra market share for Alphabet whereas considerably growing income and profitability.

The profitability half is very true for this platform. Cloud providers have loads of fastened prices (information facilities, server infrastructure, analysis and growth, and so forth.), so economies of scale play a giant function in boosting margins. Google Cloud is already seeing a serious enchancment on this entrance as its This fall working margin elevated from 9.4% to 17.5% on a year-over-year foundation. Two years in the past, the phase was nonetheless reporting a loss.

3. It is turning into too onerous to disregard Alphabet’s valuation

Valuation is not all the pieces when investing in an awesome long-term enterprise, however a pretty entry level definitely helps. Alphabet is buying and selling at lower than 21 occasions trailing-12-month earnings, far beneath its common for the previous 5 and 10 years.

It is also noticeably cheaper than any of the opposite Magnificent Seven shares as you’ll be able to see beneath.

Information by YCharts.

Alphabet faces some dangers, similar to a drop in short-term advert spending if macroeconomic situations additional deteriorate and regulatory hurdles.

Nonetheless, the enterprise is positioned to flourish in the long run. If the present volatility has you frightened, contemplate dollar-cost averaging as a option to steadily construct up your stake.

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Stefon Walters has positions in Apple and Microsoft. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.