Though progress shares have a spot in lots of portfolios, even younger, risk-tolerant buyers ought to personal some long-term worth shares. These shares that you could depend on provide the flexibility to take a position a few of your different funds in higher-risk, higher-growth potential shares, since they reduce the general threat of your total portfolio.

American Specific (AXP -1.20%) has been round since 1850 — that is fairly a monitor document of success. It is a prime inventory with a differentiated mannequin and long-term progress drivers, and it affords stability for any form of investor. Listed below are three causes to purchase it now and maintain it for at the very least 5 years.

1. The resilient shopper base

American Specific has created a model that targets the prosperous shopper, and this buyer base is extra resilient than the typical individual. That gives some safety for American Specific, and it has continued to report wholesome, worthwhile progress regardless of the inflationary atmosphere. Income elevated 10% 12 months over 12 months (foreign money impartial) in 2024, and earnings per share have been up 25% to $14.01. CEO Stephen Squeri famous that momentum elevated towards the tip of the 12 months with a robust vacation season.

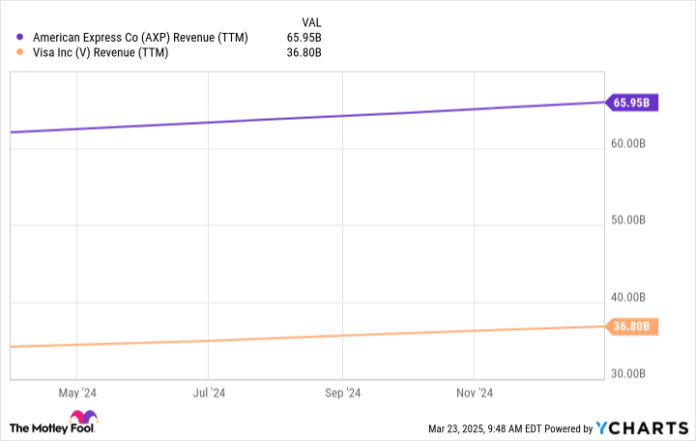

Think about that regardless that American Specific has solely a fraction of competitor Visa‘s playing cards (153 million versus greater than 2.9 billion for Visa), it takes in near double Visa’s income.

AXP Income (TTM) knowledge by YCharts.

Immediately, it is reaching a youthful shopper base. It has gone by way of a picture overhaul and is consistently refreshing its playing cards and rewards program to attraction to the trendy cardmember, and youthful members account for extra of its spending than another age group. Administration mentioned U.S. fee-based shopper premium playing cards are the fastest-growing section in its trade, and that it has 25% of these playing cards, implying lots of upside potential. Millennial and Gen Z clients are the fastest-growing age group in these playing cards, and American Specific is including them at a better charge than the general trade.

American Specific additionally acts as its personal financial institution, offering it with diversified income streams and a streamlined operational mannequin. Youthful clients are driving progress right here too, with millennial and Gen Z members accounting for half of the high-yield financial savings accounts and a 3rd of whole balances.

2. The fee-based mannequin

A method American Specific stands out is that it fees charges for a lot of of its bank cards. That creates loyalty and a recurring income stream, and card charges develop at double-digit charges yearly — 16% in 2024, accounting for practically 13% of whole income. About 70% of latest card acquisitions have been for fee-based playing cards, and administration expects price progress to remain within the mid- to excessive teenagers in 2025. It additionally has excessive renewal charges, feeding into this cycle.

Squeri identified that the U.S. shopper gold card, which is its gold-standard and has a $325 annual price, is resonating with a youthful buyer base. This membership base will drive future progress for American Specific.

3. The dividend

American Specific pays a rising dividend that yields simply over 1% on the present value, or about its common. The dividend is a vital purpose that Warren Buffett is such a fan, though he loves the entire bundle. American Specific has paid a dividend since 1989,and it is elevated greater than 200% over the previous 10 years. It simply introduced a 17% improve, from $0.70 to $0.82. That is a superb indication of how administration feels in regards to the firm’s place and power.

American Specific is a inventory you should buy immediately and maintain for years, benefiting from its function within the economic system and passive revenue.

American Specific is an promoting accomplice of Motley Idiot Cash. Jennifer Saibil has positions in American Specific. The Motley Idiot has positions in and recommends Visa. The Motley Idiot has a disclosure coverage.