Bitcoin is as soon as once more underneath strain because the market navigates a unstable and unsure part. After briefly reclaiming the $111K stage, the world’s largest cryptocurrency is struggling to keep up $110K as a secure assist zone. Sellers are regaining management, and bearish merchants are calling for a deeper retrace towards decrease vary ranges — probably under the six-figure mark.

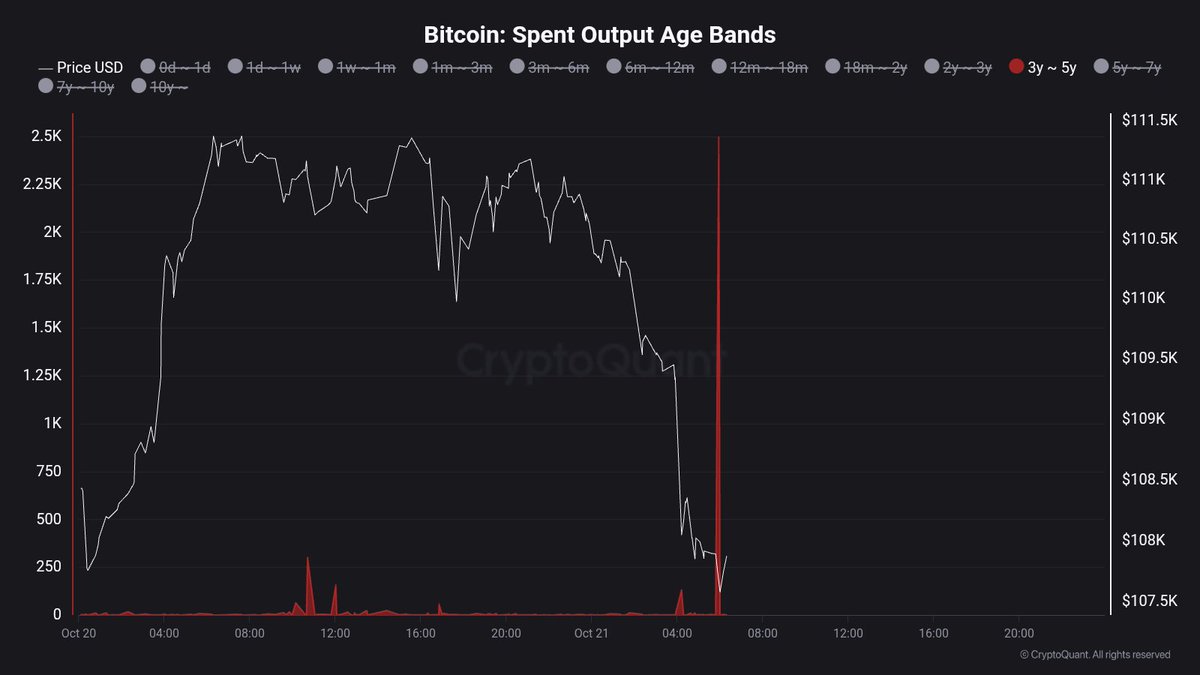

Including to the cautious tone, recent information from CryptoQuant reveals a regarding on-chain improvement: previous Bitcoin cash are waking up. This metric, which tracks beforehand dormant BTC transferring on-chain, has proven a pointy improve amongst cash aged 3–5 years, indicating that long-term holders are beginning to transfer or promote a part of their holdings. Traditionally, such habits has preceded phases of heightened volatility or deeper corrections, as these older cash typically symbolize important, high-volume provide coming into the market.

Whereas some analysts interpret these strikes as long-term holders taking income after the yr’s rally, others warn that renewed promoting from this group may intensify downward strain. As market sentiment turns defensive, merchants are watching intently to see whether or not Bitcoin can defend key assist zones or if these “previous cash” will gas the subsequent leg of a broader correction.

Lengthy-Time period Holders Transfer Provide as Promoting Strain Builds

Prime analyst Maartunn shared information revealing a notable spike in long-term holder exercise, with 3–5-year-old BTC spent leaping to 2,496 BTC — a major transfer contemplating the sometimes dormant nature of this cohort. These “previous cash” symbolize Bitcoin that hasn’t moved in years, typically held by traders with excessive conviction. When this group turns into lively, it normally indicators a serious shift in market dynamics.

Traditionally, such spikes in long-term holder exercise are likely to happen close to macro turning factors, both as an indication of distribution throughout native tops or early reaccumulation phases after deep corrections. Within the present context, this rise in aged coin motion may imply two issues. First, it would mirror profit-taking from early holders who’re capitalizing on features as market volatility intensifies. Second, it may point out reallocation or strategic rotation, the place cash transfer between wallets as traders put together for renewed market turbulence.

This comes amid a backdrop of persistent promoting strain, with Bitcoin struggling to carry above the $110K stage. The broader market stays cautious, as liquidity thins and short-term merchants react to every draw back transfer.

Whereas long-term holders transferring provide can seem bearish within the quick run, it’s additionally a pure a part of market cycles — typically previous phases of redistribution that in the end strengthen long-term construction. If Bitcoin can take up this provide and preserve assist above $106K–$108K, it may set the muse for a extra sustainable rebound. Nevertheless, failure to take action may verify a deeper correction, doubtlessly testing the $100K zone as soon as once more.

Testing Assist Amid Renewed Weak spot

Bitcoin is struggling to seek out momentum after days of promoting strain, at the moment buying and selling round $107,800. The three-day chart reveals BTC preventing to remain above the 200-day transferring common (inexperienced line) close to $106,000, a vital assist that has traditionally served as a base throughout main corrections. The bounce from the current $103K low suggests some shopping for curiosity, however momentum stays fragile as bulls try to defend this key zone.

The 50-day transferring common (blue line), sitting above $112,000, now acts as short-term resistance, with a broader provide space forming round $117,500 — the identical stage that capped earlier rallies. An in depth above this threshold may verify a short-term reversal, signaling renewed purchaser confidence. Nevertheless, repeated failures to reclaim it could invite one other wave of promoting strain.

Market construction stays neutral-to-bearish, with volatility compressing following the October 10 flash crash. If BTC loses the $106K–$107K zone, draw back targets may lengthen towards $100K, the place the yearly common gives the subsequent layer of assist.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.