President Donald Trump’s tariffs have spooked the inventory market. It’s unclear what comes subsequent within the commerce struggle with China and different international locations versus the U.S., with doubtlessly giant results on world provide chains.

This doesn’t imply it’s best to shrink back from investing in 2025. The truth is, the perfect transfer will possible be to do the alternative and lean in whereas others are leaning out — with expertise shares particularly. The market is fearful over how the commerce struggle will have an effect on the earnings of huge tech gamers in 2025, which is offering a shopping for alternative for buyers with a watch on the long run.

Listed here are two expertise shares you should buy immediately to set your self up for all times.

The world’s provider of pc chips

Semiconductors are strategically vital for the U.S. and China, in addition to different nations. With out them, a lot of the world economic system would stop to perform optimally. One firm is the spine of this business: Taiwan Semiconductor Manufacturing (TSM 2.40%), in any other case generally known as TSMC.

TSMC builds pc chips for corporations like Nvidia, Amazon (AMZN 3.62%), and Alphabet. It has factories in Taiwan and the U.S., with plans to construct extra within the coming years.

The corporate simply introduced an growth within the U.S., with an up to date plan so as to add $100 billion in spending within the nation. Nations need strong semiconductor provide chains, with the pc chips very important for cloud computing, synthetic intelligence (AI), and electrical autos.

AI and cloud computing are the place TSMC makes most of its cash, although. Final quarter, 59% of income got here from excessive efficiency computing (HPC), rising 7% quarter over quarter.

The AI market goes like gangbusters in the mean time, which means we must always get much more progress from this section within the coming quarters. In greenback phrases, TSMC expects income to develop by greater than 20% yr over yr in 2025.

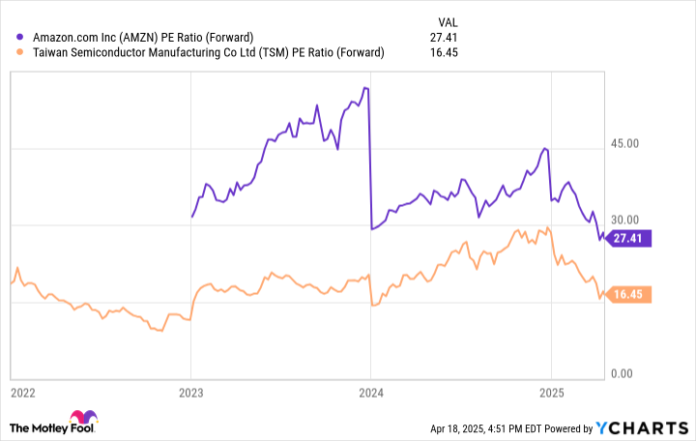

Proper now, you should buy shares at a ahead price-to-earnings ratio (P/E) of 16.5. This seems to be low cost for an organization with a robust business tailwind and a dominant place in manufacturing semiconductors.

AMZN PE Ratio (Ahead) information by YCharts; PE = worth to earnings.

Amazon’s most cost-effective a number of ever

One other tech firm with an inexpensive inventory is a buyer of TSMC: Amazon. Its inventory is getting roughed up due to tariffs, however the enterprise is effectively diversified and poised to succeed over the lengthy haul. Tariffs will harm Amazon’s e-commerce sellers because of the publicity they must Chinese language manufacturing.

However the firm is usually only a market for items, providing its success community, promoting, and Prime subscription providers for sellers and consumers. These providers will do exactly nice regardless of if items are sourced from China, Vietnam, or North America. It could be a bumpy highway attributable to tariffs, however Amazon’s roughly $400 billion in North American retail income ought to continue to grow over the long run.

We can’t overlook the enterprise’ crown jewel: Amazon Net Companies (AWS). The main cloud computing firm is benefiting tremendously from spending on AI, which requires loads of computing energy to coach and function.

Income is at present rising 19% yr over yr and is significantly greater than $100 billion yearly. Working earnings reached near $40 billion in 2024, which reveals the excessive revenue margins of the division.

With rising demand from AI and the lengthy tailwind of cloud adoption versus on-premise information facilities, AWS ought to have the ability to sustain this double-digit proportion income progress for a few years.

Right now, after a decline to start out 2025, Amazon inventory trades at considered one of its most cost-effective ahead P/E ratios ever at 27.4. This may increasingly not look extraordinarily low cost, however the firm has loads of runway left to develop revenue margins because it scales up, with present margins of simply 11% in 2024.

With AWS rising rapidly, I consider margins can develop to fifteen% or greater inside the subsequent few years. Add on some sturdy income progress, and bottom-line earnings have loads of room to rise within the years to come back.

This makes Amazon — together with Taiwan Semiconductor Manufacturing — a can’t-miss inventory to purchase immediately.

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Brett Schafer has positions in Alphabet and Amazon. The Motley Idiot has positions in and recommends Alphabet, Amazon, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot has a disclosure coverage.