Synthetic intelligence (AI) investing remains to be a dominant theme available in the market. A considerable amount of cash is being invested in constructing out AI manufacturing capabilities, and a choose group of shares is benefiting from this spending.

Two of my favorites are Nvidia (NVDA -0.64%) and Taiwan Semiconductor Manufacturing (TSM -0.65%). These two are each anticipated to expertise monster progress over the following few years, making them amongst my favourite AI shares to purchase proper now.

Picture supply: Getty Photos.

Nvidia

Nvidia manufactures graphics processing models (GPUs), specialised computing units that excel at dealing with demanding workloads. It’s because they’ll course of a number of calculations in parallel and be related in clusters to amplify that impact. With AI computing clusters generally housing 100,000 or extra Nvidia GPUs, this creates the final word AI coaching machine.

With AI hyperscalers planning to spend file quantities on information facilities in 2025, this bodes effectively for Nvidia’s long-term prospects. Knowledge facilities aren’t inbuilt a yr. The method of constructing them is prolonged and sophisticated, and if an organization decides to construct one at the moment, it could take years earlier than it turns into operational. Consequently, buyers can count on this record-setting information middle spend to persist for a number of years, indicating that Nvidia’s huge information middle GPU gross sales are prone to proceed.

Nvidia additionally acquired incredible information from the U.S. authorities not too long ago. Again in April, Nvidia’s export license for H20 chips was revoked. These chips had been particularly designed to satisfy export restrictions to China, and the revocation of its export license was slated to price Nvidia about $8 billion in gross sales through the second quarter. Whereas Nvidia nonetheless expects to generate $45 billion in income, this was an enormous blow. Nonetheless, Nvidia introduced that it’s reapplying for an export license and has assurances from the U.S. authorities that it is going to be authorized. This can result in elevated gross sales for Nvidia and allow it to proceed its spectacular progress.

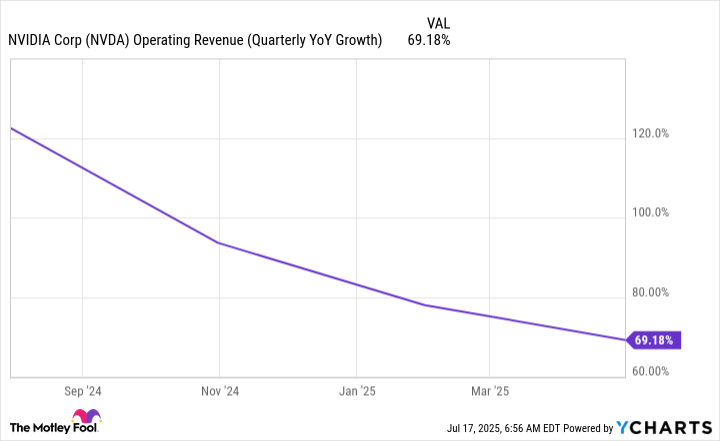

Whereas there is no such thing as a time for H20 chips to impression Q2’s gross sales numbers, it should probably have some impact on Q3’s figures. Whereas Nvidia expects 50% income progress in Q2, that quantity would have been 77% if projected H20 gross sales had been included. That might point out that Nvidia’s gross sales aren’t slowing down as rapidly because the market expects, showcasing the unbelievable progress within the AI discipline.

NVDA Working Income (Quarterly YoY Development) information by YCharts

Nvidia will proceed to be a high AI funding choice, and I feel each investor ought to have some publicity to Nvidia.

Taiwan Semiconductor Manufacturing

Taiwan Semiconductor manufactures Nvidia’s chips, as Nvidia cannot produce them in-house. TSMC additionally has different main tech corporations on its consumer checklist, together with Apple and Broadcom. Practically each firm using cutting-edge expertise is now working with Taiwan Semiconductor, which bodes effectively for its market place.

Taiwan Semiconductor established its management place in a number of methods. First, it is not competing in opposition to its clients. Taiwan Semiconductor is a chip foundry solely, and is not making an attempt to undercut its shoppers by providing chips on to customers. Second, it’s at all times on the forefront of recent chip expertise, which assures its shoppers that they’ll stay long-term clients with TSMC as an alternative of needing to hop between foundries to realize entry to new tech. Lastly, Taiwan Semiconductor has industry-leading processes that permit it to attain best-in-class yields. That is at present enjoying out within the 3nm (nanometer) chip node realm, as TSMC’s yield is round 90%, whereas the one different foundry with this expertise, Samsung, is reportedly caught at 50%.

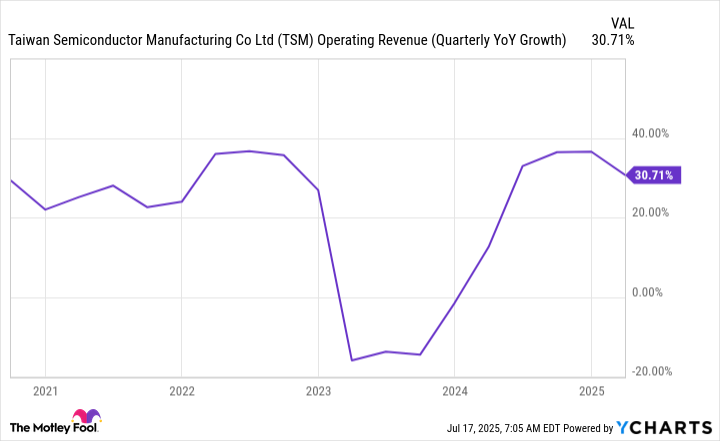

With Taiwan Semiconductor’s management place, its shoppers typically place orders years prematurely. This supplies administration with a superb view into what the long run holds, permitting it to make daring predictions, such because the one it made at the beginning of 2025. For the five-year interval beginning in 2025, administration expects AI-related income to develop at a forty five% compounded annual progress charge (CAGR). TSMC serves extra clients than simply AI-centric ones, however it nonetheless tasks its complete income to develop at a CAGR of practically 20%.

TSM Working Income (Quarterly YoY Development) information by YCharts

That is unbelievable progress, highlighting why Taiwan Semiconductor is a must-own within the AI funding world.

Each Taiwan Semiconductor and Nvidia are incredible funding choices within the AI realm proper now. Every is anticipating huge progress, giving buyers an incredible alternative to outperform the market over the following 5 years.

Keithen Drury has positions in Broadcom, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Broadcom. The Motley Idiot has a disclosure coverage.