There is not any doubt that buyers could make hundreds of thousands of {dollars} by investing in electrical automotive shares. Simply ask long-term holders of Tesla (NASDAQ: TSLA). Regardless of heavy ups and downs through the years, shares are up by greater than 22,000% since 2010.

On the lookout for the following Tesla? The 2 EV shares under are for you.

This EV maker ought to double its gross sales in 2025

For those who’re searching for EV shares with enormous progress potential, begin with Lucid Group (LCID -2.15%). In comparison with the opposite shares on this checklist, Lucid is rising the quickest right now, and there is purpose to consider excessive progress might be achievable for a number of extra years to return.

Final yr, Lucid solely had one EV available on the market: The Lucid Air. This mannequin got here in a number of variants, however all primarily got here all the way down to a luxurious electrical sedan priced between $70,000 and $250,000, relying on choices. The Air was a formidable preliminary car for Lucid, serving to develop the corporate’s gross sales to just about $1 billion. However the Lucid Air had extreme limitations. Its excessive price priced out many of the market, whereas its sedan kind issue deterred anybody searching for one thing roomier, like an SUV.

Earlier this yr, Lucid solved half of that problem with the launch of its Gravity SUV platform — primarily doubling its lineup. Analysts count on gross sales to develop by 82% this yr, and one other 91% subsequent yr, as a consequence of demand for Lucid’s SUV platform. However with a begin worth of practically $100,000, the Gravity nonetheless prevents Lucid from tapping the mass market. That might all change in 2026, nevertheless, when the corporate expects to launch a number of new automobiles, all priced underneath $50,000.

There’s loads of threat to this story. Ramping manufacturing of a number of new fashions over the following 12 to 24 months will put a pressure on Lucid’s already constrained monetary place. In terms of uncooked progress potential, Lucid tops the checklist of “subsequent Tesla” candidates. However for balancing progress and worth, the following inventory is definitely my favourite proper now.

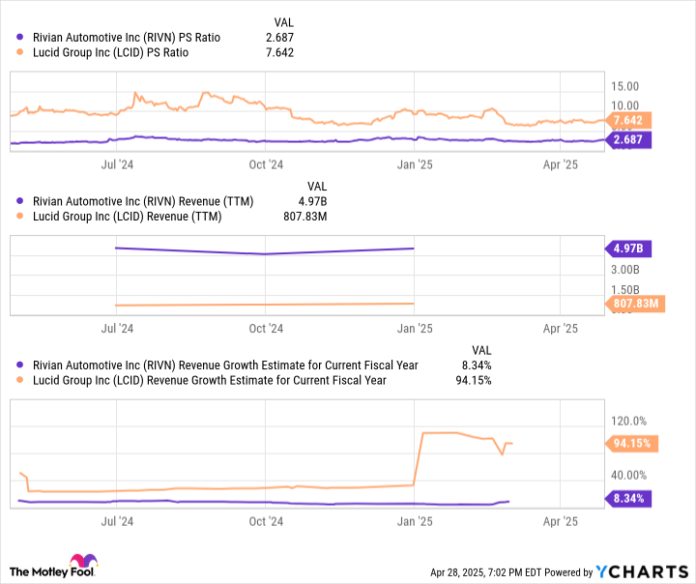

RIVN PS Ratio knowledge by YCharts. PS = price-to-sales.

My favourite electrical automotive inventory this decade

Regardless of Lucid’s speedy anticipated progress charges in 2025, Rivian (RIVN 2.71%) stays my high electrical car inventory this decade. This story is a little more difficult, however when you dig in, it is clear that Rivian shares present an enormous alternative for affected person shareholders.

Like Lucid, Rivian solely has two luxurious fashions available on the market, with excessive preliminary worth factors: The R1S and the R1T. However in roughly 12 months, the corporate expects to start out manufacturing on three new inexpensive automobiles — the R2, R3, and R3X. By all accounts, Rivian is additional alongside in getting its lower-priced automobiles to market than Lucid. Plus, the corporate has billions in extra money with a present gross sales base greater than 5 instances that of Lucid. So which firm is extra more likely to see its new inexpensive fashions get to market? I consider Rivian is best positioned.

Proper now, Rivian’s valuation is way under Lucid’s, largely as a consequence of lackluster anticipated gross sales progress this yr. However if you look past the following 12 months, I count on these progress charges to select up significantly when its new fashions hit the roads. Whereas extra persistence will likely be required for Rivian, this enterprise has one of the best long-term progress potential at an affordable valuation right now.

Ryan Vanzo has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot has a disclosure coverage.