The high-flying chipmaker has misplaced momentum previously three months, however it might make a strong comeback in 2025.

Nvidia (NVDA -0.18%) inventory has delivered gorgeous returns as soon as once more in 2024 following a blistering efficiency final 12 months, however a more in-depth have a look at the corporate’s worth chart will inform us that it has misplaced momentum over the previous three months.

Nvidia inventory has remained flat throughout this era due to doubts surrounding the corporate’s synthetic intelligence (AI)-related prospects and its potential to proceed delivering eye-popping development. Buyers could also be questioning if they need to be shopping for extra shares of this semiconductor big or begin reserving income. Nevertheless, it will not be stunning to see Nvidia inventory regaining its mojo and delivering one other stellar 12 months in 2025.

On this article, we’ll try a few the explanation why shopping for Nvidia inventory earlier than 2025 is a no brainer.

Nvidia is anticipated to ship extra AI chips subsequent 12 months

Analysts predict Nvidia to witness a considerable enhance in shipments of its AI graphics processing items (GPUs) in 2025. Market analysis agency TrendForce believes that Nvidia might witness a 55% enhance in shipments of its AI GPUs subsequent 12 months, pushed by the arrival of the corporate’s next-generation Blackwell processors.

TrendForce estimates that Blackwell will account for 80% of Nvidia’s AI GPU shipments subsequent 12 months. This additionally implies that the shipments of Nvidia’s older era Hopper chips will proceed to stay strong as nicely in 2025. The nice half is that TrendForce is not the one one anticipating a leap in Nvidia’s AI GPU gross sales subsequent 12 months.

Japanese funding financial institution Mizuho has raised its estimate for Nvidia’s 2025 AI GPU shipments by 8% to 10% as in comparison with its prior estimate issued in July this 12 months. Mizuho credit this upward revision to an enchancment within the firm’s provide chain. Extra particularly, Nvidia’s foundry companion Taiwan Semiconductor Manufacturing (popularly often known as TSMC) is reportedly going to double its superior packaging capability, which is able to enable the previous to fabricate extra AI GPUs.

Furthermore, TSMC plans to proceed rising its superior packaging capability past subsequent 12 months as nicely. The foundry big believes that it will likely be in a position to clock an annual development fee of no less than 60% in its chip-on-wafer-on-substrate (CoWoS) packaging capability via 2026. This could place Nvidia in a pleasant place to capitalize on the fast-growing demand for AI chips.

Allied Market Analysis estimates that gross sales of AI chips might enhance at an annual fee of 38% via 2032, producing $384 billion in annual income. Nvidia is the dominant participant within the AI chip market with a market share that is estimated between 70% and 95%, although a more in-depth have a look at its AI income as in comparison with that of its rivals will point out that its share is probably going on the increased finish of that vary.

Extra importantly, TSMC’s bettering manufacturing profile ought to be certain that Nvidia maintains its dominance within the AI chip market. So, increased gross sales of AI GPUs ought to translate into strong development for Nvidia within the subsequent fiscal 12 months, whereas its pricing energy on this market would result in wholesome development in its backside line as nicely.

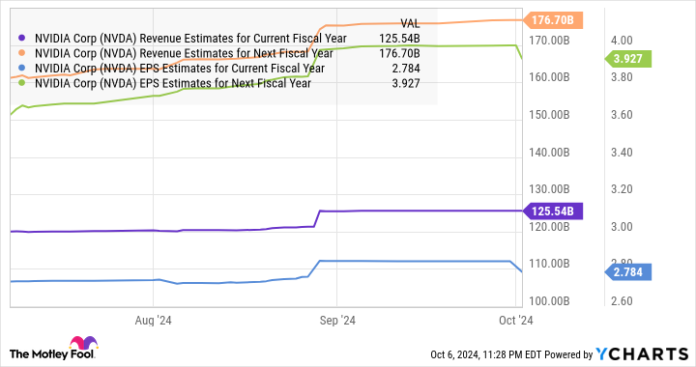

NVDA Income Estimates for Present Fiscal 12 months knowledge by YCharts

The valuation should not be a priority contemplating its potential development

Some may level out that Nvidia is richly valued proper now with a trailing price-to-earnings ratio (P/E) of 58, which is increased than the Nasdaq-100 index’s common earnings a number of of 32. However on the identical time, Nvidia has been in a position to justify its valuation with excellent development. In truth, Nvidia’s earnings a number of is presently decrease than its five-year common P/E of 72.

Additionally, Nvidia’s worth/earnings-to-growth ratio (PEG ratio) of simply 0.14 implies that the inventory may be very a lot undervalued contemplating the expansion that it’s forecasted to ship.

NVDA PEG Ratio knowledge by YCharts

The PEG ratio is a valuation metric that takes into consideration the potential earnings development that an organization might ship. A studying of lower than 1 implies that the mentioned inventory is undervalued. That is why now could be time for buyers to load up on Nvidia inventory earlier than the potential leap in gross sales of the corporate’s AI chips in 2025 sends it hovering.

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Idiot has a disclosure coverage.