It is time to take one other have a look at these dividend giants.

Dividend traders have some benefits over traders who focus solely on development shares. The portfolio earnings they generate typically grows over time and might buffer weak returns when markets are flat or declining. And in the event you select to mechanically reinvest the dividends, you possibly can accumulate extra shares when costs are low and amplify your long-term returns.

With these optimistic factors in thoughts, let us take a look at two engaging dividend shares value shopping for proper now.

Picture supply: Getty Photographs.

1. PepsiCo inventory is bubbly

PepsiCo‘s (PEP -0.47%) dividend yield seems tempting at above 3.5% immediately. Certain, that prime yield is partly due to the inventory underperforming the market over the previous two years. Wall Avenue execs are disenchanted with the shopper staples big’s 1.7% natural gross sales development to this point in 2025, in comparison with 2024’s 2% uptick. Administration is anticipating earnings to be flat this yr, too, as the corporate works to go alongside larger prices in an period of sluggish demand development.

But there’s lots to love about this investing story. Pepsi is very worthwhile with an working margin sitting at 18% of gross sales. The corporate is on observe to return almost $9 billion to shareholders this yr, primarily by means of dividend funds. And the 5% dividend hike the corporate introduced for 2025 was its 53rd consecutive annual elevate, that means it is a Dividend King. As for dashing development again up, Pepsi is busy reshaping its portfolio to capitalize on demand for extra health-focused drinks and snacks. It not too long ago closed a $2 billion buy of the Poppi prebiotic soda model.

You possibly can personal the inventory for two.2 instances gross sales, in comparison with the three instances gross sales (price-to gross sales valuation) that traders had been paying for Pepsi in 2023. That low cost ought to pave the best way for higher returns from right here, even when it takes time for the corporate to speed up natural gross sales positive aspects again up towards the ten% spike that shareholders loved in 2023.

2. McDonald’s seems tasty

In early August, McDonald’s (MCD -0.13%) had some excellent news for traders to rejoice in its Q2 earnings report. The restaurant firm returned to comparable-store gross sales development as positive aspects hit 4% in comparison with the prior quarter’s slight decline. Administration credited its give attention to worth together with aggressive spending in areas like cell ordering and supply. “Our expertise investments and talent to scale digital options at velocity will proceed to raise the McDonald’s expertise,” CEO Chris Kempczinski mentioned .

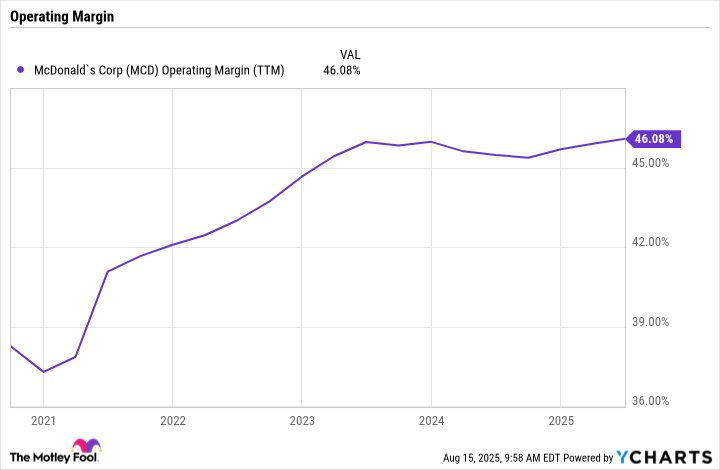

These investments aren’t harming profitability, both. McDonald’s posted 5% larger Q2 earnings and ample free money circulation. The chain’s working margin continues to climb towards 50% of gross sales.

MCD Working Margin (TTM) information by YCharts

Shareholders will wish to see extra enhancements in development traits within the second half of 2025. I will be expecting McDonald’s to return to buyer site visitors positive aspects, too, so it would not need to rely a lot on larger common spending in its eating places or on the digital promoting channel.

In any case, this 2.6%-yielding dividend inventory has shot at boosting your portfolio returns from right here, given its sluggish efficiency to this point in 2025. Buyers are clearly extra taken with tech shares proper now, and that is creating a possibility for earnings traders to select up shares of high-performing firms like McDonald’s and PepsiCo, securing a few years of rising dividend funds within the course of.