Development shares should not for the faint of coronary heart. In bear markets — just like the one buyers are experiencing in April 2025 for the Nasdaq Composite Index — development shares are going to tumble amid lots of volatility. As of this writing, a lot of your favourite development shares are down 20%, 30%, or extra in only a quick few months.

Shopping for into weak point like this may really feel scary. What should you do not completely time the underside? That is not the proper query to ask. When everybody panics and their time horizons shrink to the following week, that’s the time to increase your time horizon and take into consideration shopping for shares to carry for the following 10 years.

Many development shares which might be down large look low cost in the intervening time and will present implausible returns over the following 5 to 10 years. Listed below are two development shares I believe can go parabolic and ship implausible beneficial properties on your portfolio.

1. Coupang: A know-how participant exterior the USA

Fearful about tariffs impacting client spending in the USA? You then would possibly like Coupang (CPNG -6.55%), a South Korean on-line market with similarities to Amazon. It doesn’t promote into the USA and — except South Korea imposes tariffs on China and different Asian nations — ought to see minimal disruptions from these tariff insurance policies which might be upending U.S. markets.

Taking away the tariff noise, Coupang is an outstanding enterprise with a implausible monitor document of development. Regardless of overseas foreign money headwinds when calculating financials in U.S. {dollars}, Coupang’s income boomed 24% yr over yr to $30.3 billion in 2024. With the U.S. greenback beginning to depreciate versus foreign currency, this headwind could flip right into a tailwind in 2025.

Buyers love the Coupang market due to its wide array and ultra-fast supply instances. It additionally provides video streaming, grocery supply, and even set up of home equipment and objects corresponding to tires on your automobile. Not even Amazon provides this stage of service.

With solely a small sliver of the general South Korean retail market, Coupang has loads of room to develop within the years to return. And it’s starting to generate free money move, at $1 billion in 2024. Inside a few years, I anticipate Coupang’s income to succeed in $50 billion; $5 billion in earnings, or only a 10% revenue margin, is achievable on this income base, which is what administration is guiding for.

At present, Coupang has a market cap of below $40 billion. This implies it trades at a ahead price-to-earnings ratio (P/E) beneath 8, a dust low cost determine for a fast-growing firm like Coupang. At these low cost costs, I believe Coupang inventory is able to go parabolic over the following decade.

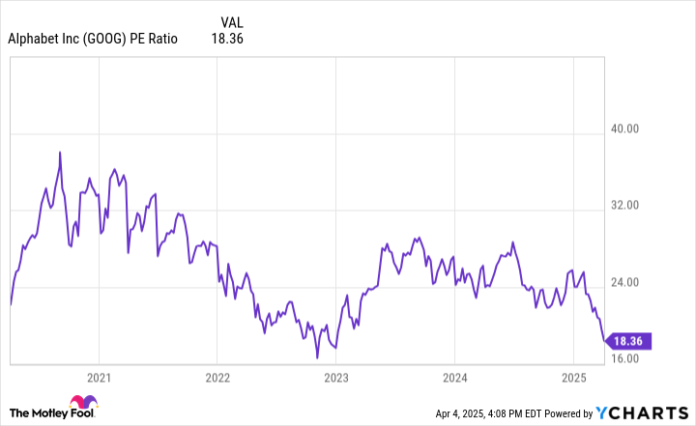

GOOG PE Ratio information by YCharts

2. Alphabet: AI potential is underrated

The second inventory that would probably go parabolic is true within the whipsaw of the Trump tariff tantrum. It’s know-how big Alphabet (GOOG -3.21%) (GOOGL -3.43%), mother or father firm of Google. The inventory has been hit in latest months over considerations about synthetic intelligence (AI) competitors, and this broad market sell-off is now including to the ache. As of this writing, the inventory’s trailing P/E ratio is eighteen, which is effectively beneath the S&P 500 index’s common of 27.

Alphabet is criticized for not dominating the AI market, however I do not suppose that is the suitable technique to body the state of affairs. It’s the main researcher and developer of latest know-how instruments and has an advantaged place with its homegrown AI-focused pc chips optimizing its information facilities.

Traders ought to see AI as a chance for Google Search, YouTube, and Google Cloud to develop, not a aggressive risk resulting in disruption. Certain, Google is not going to be a monopoly in search anymore, however that does not imply the corporate’s income goes to zero when it performs in a market which may be value trillions of {dollars} in a decade.

Traders are seeing this in Alphabet’s financials. Google Cloud income grew 30% yr over yr within the fourth quarter of 2024. YouTube promoting grew 14%. Google Search — which is outwardly getting disrupted by AI — grew 12.5% to $54 billion. Sure, $54 billion in income in only one quarter.

Alphabet additionally constantly repurchases its inventory and simply began to pay a dividend to shareholders. Add all of it collectively, and Alphabet seems to be like a implausible development inventory to purchase and maintain for the lengthy haul. Zoom out and give attention to the following decade to see that this can be a high-quality enterprise you should purchase an possession stake in at a comparatively low cost worth.

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Brett Schafer has positions in Alphabet and Coupang. The Motley Idiot has positions in and recommends Alphabet. The Motley Idiot recommends Coupang. The Motley Idiot has a disclosure coverage.