Given the sturdy momentum for AI, is Wall Road considerably underestimating Nvidia and its AI-powered development?

Nvidia (NVDA 0.65%) inventory has been risky recently. Following current sell-offs pushed by geopolitical threat components and a few disappointing earnings stories from different large tech corporations, Nvidia inventory has fallen greater than 16% from its excessive.

However current protection printed by Loop Capital means that Nvidia might be poised for a rebound and rally over the subsequent 12 months. In a be aware printed July 22, the agency’s lead analyst on the inventory, Ananda Baruah, reiterated a purchase ranking on the bogus intelligence (AI) chief. Baruah additionally raised his one-year value goal on the inventory from $120 per share to $175 per share. With the inventory priced at $114.25 per share as of this writing, the brand new goal would counsel an upside of 54% over the subsequent 12 months.

Is Wall Road underestimating Nvidia inventory?

In Loop Capital’s current write-up on Nvidia, Baruah mentioned that he thinks Nvidia has the potential to considerably outperform Wall Road’s expectations. Particularly, the analyst thinks that the corporate’s knowledge middle section might ship income of between $215 billion and $240 billion — far forward of the common analyst estimate’s name for gross sales of $145 billion. Baruah additionally thinks that the AI chief’s compute section can ship gross sales of between $200 billion and $225 billion — forward of the common Wall Road goal’s name for gross sales of $132 billion.

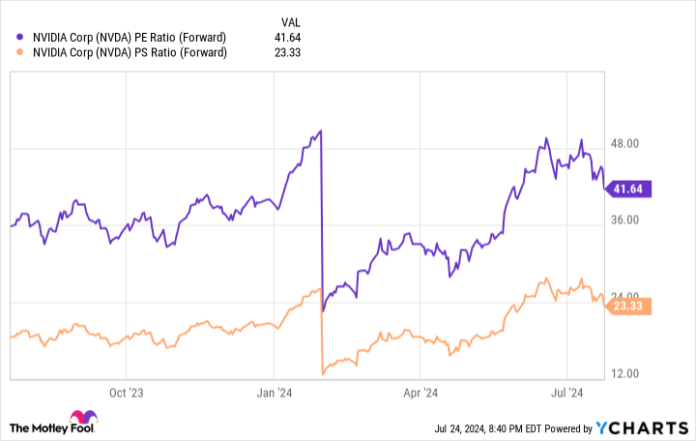

NVDA PE Ratio (Ahead) knowledge by YCharts.

With the unimaginable velocity at which the enterprise is increasing, Nvidia inventory might nonetheless be low cost regardless of additionally having a growth-dependent valuation. Final quarter, Nvidia’s income surged 262% 12 months over 12 months to hit $26 billion — and earnings per share soared 629% in comparison with the prior-year interval.

Whereas it stays to be seen how lengthy the stellar development momentum will proceed, Nvidia appears to be like poised for sturdy demand by way of the rest of the 12 months and may proceed to put up very spectacular margins. For long-term traders trying to again leaders within the AI revolution, the current inventory pullback might be a shopping for alternative.

Keith Noonan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.