Cava Group (CAVA 0.14%) has been top-of-the-line restaurant shares to personal this yr. The fast-casual Mediterranean-style restaurant chain has been profitable over not simply prospects, however traders as effectively. Via enlargement and new menu choices, it has been capable of frequently report strong numbers, propelling its share value to new heights.

Not too long ago, the corporate reported its newest earnings numbers, and one metric stood out to me. It highlights the enterprise’s spectacular development, and it is an incredible signal that the corporate goes in the best course.

Cava’s same-restaurant gross sales got here in at 18.1%

For a restaurant chain, producing single-digit comparable gross sales development is an efficient purpose, particularly amid immediately’s financial situations as customers are reducing again on spending.

However you would not know the economic system is going through these challenges in case you checked out Cava’s numbers. That is as a result of for the newest interval, which ended on Oct. 6, the corporate reported its comparable restaurant gross sales development was a formidable 18.1%. By comparability, Chipotle Mexican Grill reported comparable restaurant gross sales development of 6% for its most up-to-date quarter (ended on Sept. 30). And the numbers look even higher for Cava in case you examine its outcomes to the worldwide beast that’s McDonald’s — for its September quarter, world comparable gross sales declined by 1.5%.

Comparable restaurant gross sales are a key metric for eating places as they inform traders how effectively the enterprise is doing when factoring in places that had been open a yr in the past. This excludes the constructive influence new restaurant openings would have on the highest line.

However this additionally works to the benefit of firms with smaller footprints resembling Cava, which can goal high-growth areas first and as they grow to be bigger and unfold out, their development fee might start to steadily come down. Nonetheless, it is a good indicator of Cava’s development and the potential it has to proceed producing robust numbers as demand appears to be like strong.

A quick development fee has made Cava a stellar funding to personal

A giant motive Cava is a sizzling inventory to personal this yr is due to its development potential. The corporate frequently opens extra shops. On the finish of the newest quarter, the corporate had 352 eating places, up from 290 a yr in the past. Its purpose is to have 1,000 places by 2032.

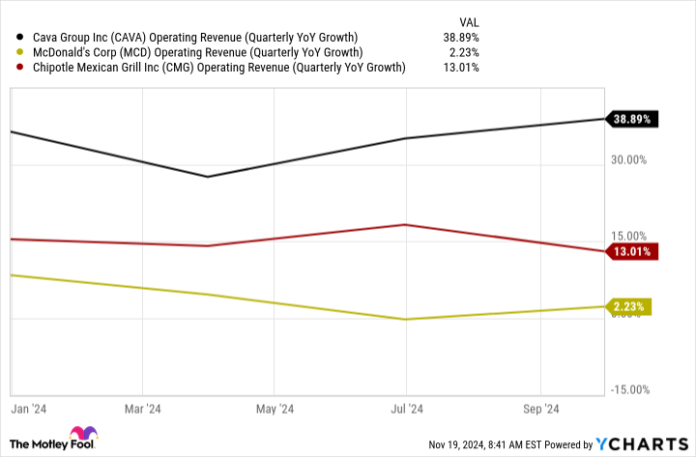

Cava’s development fee has been spectacular compared to different restaurant chains, and with such bold targets forward, that development is prone to proceed within the years forward.

CAVA Working Income (Quarterly YoY Progress) information by YCharts

Is Cava’s excessive valuation an issue?

As of Monday’s shut, Cava’s inventory was up a staggering 219% as there was no scarcity of bullishness across the enterprise of late. Whereas that is nice for shareholders, people who find themselves looking to buy the inventory for the primary time might really feel as if they’ve missed the boat.

Cava Group’s gross sales grew by almost 40% final quarter to $243.8 million. Its web revenue rose at an excellent quicker fee of 163%, coming in at just below $18 million. Whereas that’s spectacular, it nonetheless leads to a reasonably modest per-share revenue of simply $0.16. Cava’s inventory closed at $137.24 on Monday, placing its price-to-earnings a number of at greater than 330. Even primarily based on analyst projections, it is buying and selling at over 277 occasions subsequent yr’s income. These are steep multiples and traders can be justified in considering twice about whether or not the inventory is an efficient purchase at its present ranges as a result of with such excessive multiples, you might be successfully paying for lots of future development.

Whereas Cava should be funding to carry for the long run, traders also needs to mood their expectations because it might be a bumpy trip forward. Though it is a fast-growing firm, its extraordinarily excessive valuation means that there’s just about no margin of security with the inventory and it might be weak to a sell-off beneath weaker market situations.

David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Chipotle Mexican Grill. The Motley Idiot recommends Cava Group and recommends the next choices: brief December 2024 $54 places on Chipotle Mexican Grill. The Motley Idiot has a disclosure coverage.