Study which exchange-traded fund is a great alternative proper now.

Finally it isn’t the inventory market nor even the businesses themselves that decide an investor’s destiny. It’s the investor.

— Peter Lynch, “One Up on Wall Road”

Investing is about making selections. There are millions of shares and associated merchandise to select from, and profitable investing depends on making the fitting decisions and sticking to a recreation plan.

That is why I am keen on exchange-traded funds (ETFs). They provide the flexibility to simply put money into a basket of shares, serving to to diversify one’s portfolio. What’s extra, many do all this at a low value.

Let’s take a look at one ETF that I consider is a no brainer purchase proper now.

What’s the Invesco QQQ Belief?

The Invesco QQQ Belief (QQQ 0.54%) is an ETF that tracks the Nasdaq 100, an index made up of the biggest non-financial shares listed on the Nasdaq alternate.

The ETF and underlying index are each closely weighted to the expertise sector, and the fund’s prime holdings embody Microsoft, Nvidia, Apple, Amazon, and Meta Platforms.

How has the Invesco QQQ Belief carried out?

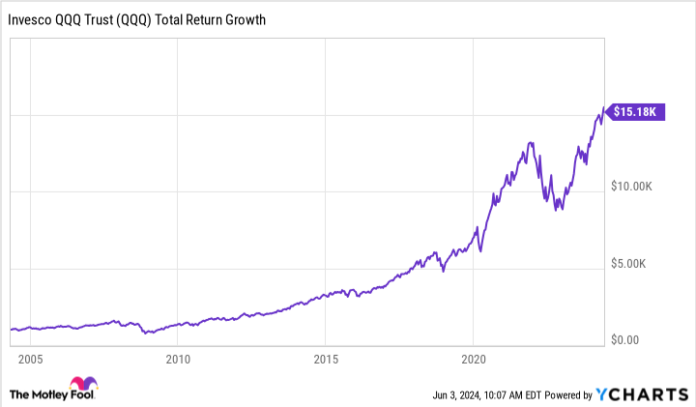

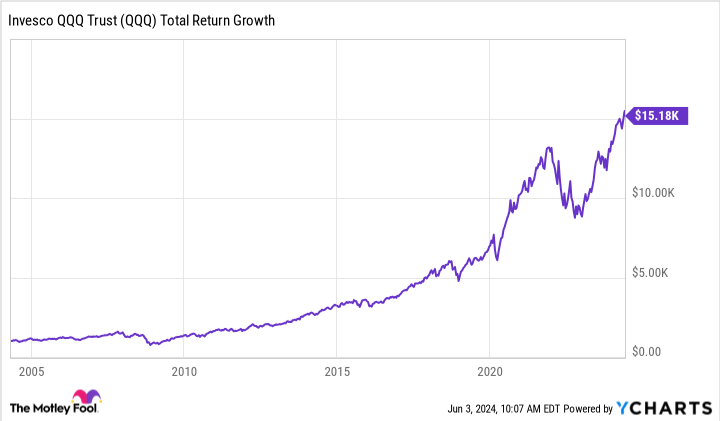

Let’s lower to the chase: This fund has been an excellent funding. During the last 20 years, the ETF has registered a whole return of over 1,400%, equating to annual progress of 14.5%. An preliminary funding of $1,000 in 2004 would have grown to nearly $15,200 at present.

Information by YCharts.

Evaluate that to the S&P 500, which has generated a ten.2% annual whole return over the identical interval. The Dow Jones Industrial Common additionally did not sustain with a 9.2% annual return, and the Russell 2000 index lagged even additional behind with an 8.1% return.

Information by YCharts.

Over a long-term interval like 20 years, these variations in annual returns add as much as important variations within the worth of your funding.

Is the Invesco QQQ Belief a purchase now?

The expansion of expertise and the way it has modified the lives of billions of individuals is the story of our lifetime, and that narrative is not going to alter anytime quickly.

Consequently, expertise firms will stay a few of market’s greatest winners for many years to return, however not all firms firms will thrive — and even survive. That is one of many core benefits of investing in an index fund. The Invesco QQQ Belief holds 101 shares, and this diversification permits winners to stability out any losers, serving to the general ETF develop over time.

Briefly, the Invesco QQQ Belief is a strong alternative that’s worthy of consideration for any investor who needs publicity to progress shares of their portfolio.

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Amazon, Invesco QQQ Belief, and Nvidia. The Motley Idiot has positions in and recommends Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends Nasdaq and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.