The inventory market indexes lately made new all-time highs. A resilient financial system, rates of interest that ought to pattern down, enthusiasm for an anticipated corporate-friendly incoming administration, enthusiasm for synthetic intelligence (AI), and high-flying tech shares like Nvidia and Microsoft all play a job on this bull market.

Buyers ought to train some warning at these ranges. Keep in mind that 2021 euphoria shortly turned to dread in 2022. There are pockets of the market that resemble 2021 now. For example, Palantir‘s inventory trades for 56 instances gross sales and over 160 instances ahead earnings. It is a terrific firm, however it is a nosebleed valuation by any measure.

Nonetheless, some firms nonetheless commerce for cheap valuations with long-term constructive tendencies. Right here is one to think about.

Do not sleep on Airbnb

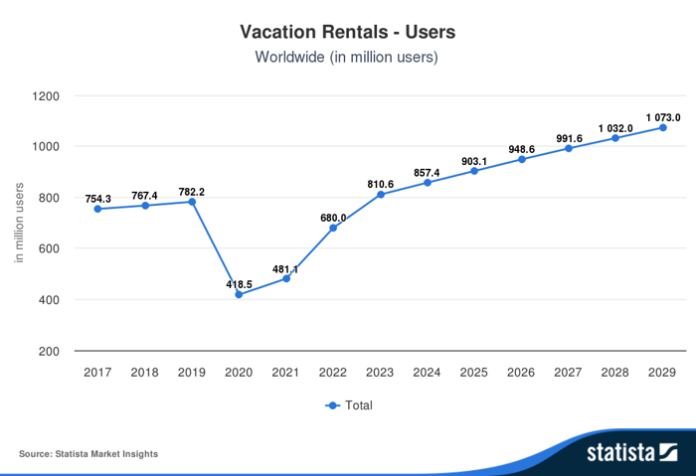

Trip habits are altering. Youthful generations e book trip leases at the next charge than older generations, who stick extra to conventional accommodations. As proven beneath, the variety of trip rental customers will rise 25% from 2024 to 2029.

Chart created by Statista.

The pattern signifies that Airbnb (ABNB 3.06%) has a long-term tailwind. Airbnb can be extremely profitable now.

Income hit $3.7 billion final quarter on 10% year-over-year progress, and working earnings reached $1.4 billion on unbelievable 37% progress. Nonetheless, what I like most in regards to the firm is the power to provide free money circulate. Airbnb operates with a lean enterprise mannequin and would not have vital capital expenditures (capex) wants, a lot of its income falls into the corporate’s pocket. Of the $10.8 billion gross sales over the previous 12 months, $4.1 billion was transformed to free money circulate, a terrific 38% margin.

Having large free money circulate permits Airbnb to fund progress, preserve a fortress steadiness sheet, and repurchase shares. As of the third quarter, the corporate reported $11.3 billion in money and investments towards simply $2 billion in long-term debt. The corporate additionally repurchased $2.6 billion in shares by means of three quarters of 2024, amounting to greater than 3% of the corporate’s present market cap.

Is Airbnb inventory funding?

Airbnb inventory trades at an analogous valuation to its rival Reserving Holdings (BKNG -0.65%) primarily based on free money circulate, as proven beneath.

ABNB Value to Free Money Movement information by YCharts

This is smart, because the enterprise fashions and monetary outcomes are comparable. It additionally reveals the significance of free money circulate in valuing these firms. Airbnb is buying and selling barely beneath its current common and effectively beneath current peaks.

Each are terrific funding choices; nevertheless, Airbnb’s market cap is round half of Reserving’s, so it has extra room to compound.

Essentially the most vital threat to Airbnb is regulatory. Many localities and owners associations have guidelines limiting short-term leases. Airbnb works proactively with policymakers to craft mutually useful rules to mitigate the chance.

Airbnb will profit from the long-term pattern towards trip leases. The fast rise in customers and its top-notch monetary outcomes make the inventory a wonderful long-term choose.

Bradley Guichard has positions in Airbnb and Reserving Holdings. The Motley Idiot has positions in and recommends Airbnb, Reserving Holdings, Microsoft, Nvidia, and Palantir Applied sciences. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.