Atlassian, as soon as an ideal progress inventory story, is now up a meager 25% over the previous 5 years.

Work administration software program chief Atlassian (TEAM 2.51%) has been an ideal instance of a enterprise that has grown in grand trend, however delivered little in the best way of optimistic shareholder returns. Share costs are down effectively over 20% up to now in 2024, doing little to reverse what has been a lackluster story within the wake of the pandemic and cloud software program inventory meltdown.

That mentioned, Atlassian has made loads of different stakeholder accomplishments over its lifespan, and there could possibly be super worth right here. Certainly, the place many rising software program tales have completely withered, this one has endured by many counts.

Is it time to purchase the dip on Atlassian regardless of the dangers?

Plenty of progress, simply not the sort buyers need proper now

Atlassian has been on a multi-year journey migrating clients from “Server” merchandise (a perpetual license to make use of software program) to “Knowledge Heart” and Atlassian “Cloud” (cloud being the final word objective emigrate clients to, the place the corporate absolutely manages the product and delivers frequent updates, enhancements, and new options). Server merchandise have been sunsetted a couple of years in the past, with ongoing assist migrating to Knowledge Heart and Cloud merchandise.

Within the third quarter of fiscal 2024 (the three months led to March), administration reported a heat-up in migrations to Knowledge Heart and Cloud. This included a document 64% year-over-year improve in Knowledge Heart income as some current clients determined to lastly pull the plug and transfer away from the outdated non-supported Atlassian on-premises server software program. Little question new synthetic intelligence (AI) options are motivating current clients to improve. Atlassian says early adopters are getting an ample enhance in productiveness by unlocking the automation of workflow duties and worker ticket completion inside its merchandise.

On account of the continued Atlassian migrations to Knowledge Heart and Cloud, whole income grew 30% yr over yr in Q3 to $1.19 billion.

However there’s extra to the story serving to propel Atlassian’s enlargement. Within the final yr, quite a lot of acquisitions have been made, together with the practically $1 billion buy ($1.5 billion in Australian {dollars}) of tech employee video creation platform Loom. A few smaller software program firms have been additionally bought: AirTrack, used to account for, observe, and analyze digital knowledge, and Optic, which labored with OpenAI to develop API documentation and administration instruments for software program engineering groups.

Partly as a result of purchases, plus the profit from extra Knowledge Heart and Cloud software program gross sales, Atlassian’s present deferred income on the stability sheet (income collected, however not but recorded as such till companies are rendered to clients) elevated by $336 million in Q3 in comparison with the yr prior. The complete integration of Loom particularly (the completion of the Loom takeover was in November 2023) might hold this metric rising within the coming quarters, and result in extra acceleration in income progress round that 30% mark.

All of it provides as much as incredible progress for the highest canine in workflow administration software program (it is nonetheless far and away the chief, in entrance of friends like Monday.com, Asana, and Smartsheet), however buyers are nonetheless on the lookout for extra monetary progress elsewhere.

One key metric on the point of ratchet increased?

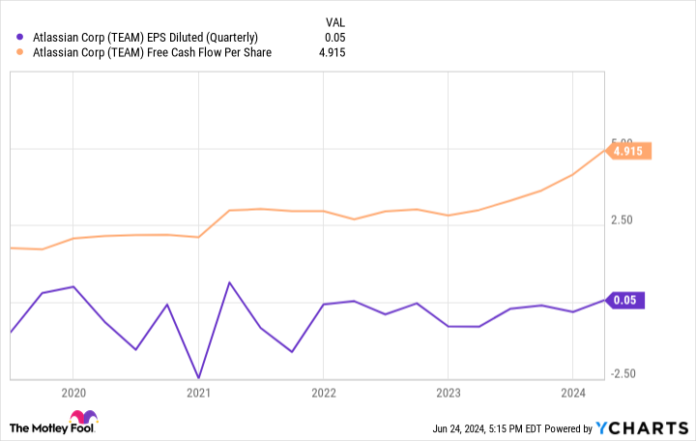

On a per-share foundation, free money stream has risen below 200% in 5 years. Paired with the flat inventory value, it is turned Atlassian from a high-flying however premium-priced inventory to 1 that seems downright affordable (a minimum of by this metric) at round 30 occasions trailing 12-month free money stream.

Nevertheless, GAAP earnings per share (EPS) are nonetheless adverse during the last trailing 12 months, though EPS lastly flipped to optimistic territory (at $0.05 per share) within the latest quarter.

Knowledge by YCharts.

That is what nonetheless has the market feeling glum on Atlassian. Even after a punishing bear market the place buyers demanded increased GAAP earnings, the corporate has nonetheless doled out $808 million in worker stock-based compensation (SBC) by the primary 9 months of its fiscal 2024. That is the first metric preserving a lid on extra strong GAAP profitability. Till extra price controls are enforced, Atlassian shares might proceed to wrestle for course.

That mentioned, progress on this entrance is bettering dramatically. Even with the massive quantity of SBC, GAAP web loss of $209 million in Q3 2023 improved all the best way to web revenue of $12.8 million in Q3 2024. If the corporate retains that up, the market might ultimately begin to take discover.

I haven’t got any room in my portfolio to nibble right here, however after the newest earnings replace, Atlassian is likely to be a good cloud software program guess proper now — assuming optimistic progress continues on profitability.

Nicholas Rossolillo and his purchasers have positions in Monday.com. The Motley Idiot has positions in and recommends Asana, Atlassian, Monday.com, and Smartsheet. The Motley Idiot has a disclosure coverage.